Understanding credit risk is paramount in the lending industry. Lenders constantly navigate a complex landscape where the potential for loss due to borrowers’ inability to repay is ever-present. This involves a multifaceted assessment of borrowers’ financial health, encompassing credit scores, financial statements, and the availability of collateral. The effective management of credit risk is crucial for the financial stability of lending institutions, influencing lending decisions, interest rates, and ultimately, profitability.

This exploration delves into the core components of credit risk, examining various assessment methods, the role of credit scores, and the unique challenges presented by different lending products like credit cards. We will analyze how financial statements reveal crucial insights into a borrower’s creditworthiness and how collateral mitigates risk. Finally, we’ll discuss strategies for effective credit risk management and mitigation, ensuring sustainable lending practices.

Collateral and its Impact on Credit Risk

Collateral plays a crucial role in mitigating credit risk for lenders. It acts as a safety net, providing a source of repayment should the borrower default on their loan obligations. The presence of sufficient and valuable collateral significantly reduces the lender’s exposure to potential losses, making them more willing to extend credit, often at more favorable terms.Collateral’s impact on credit risk is multifaceted.

It influences both the probability of default and the potential loss given default (LGD). By reducing the LGD, collateral lowers the overall risk profile of the loan. This allows lenders to offer better interest rates or approve loans for borrowers who might otherwise be considered too risky. Furthermore, the presence of collateral can incentivize borrowers to perform on their loan agreements, as they risk losing a valuable asset.

Types of Collateral

Different types of collateral possess varying degrees of liquidity and value stability, influencing their effectiveness in mitigating credit risk. Common types include real estate (property), which is generally considered a stable and relatively illiquid asset; financial assets like stocks and bonds, which are liquid but subject to market fluctuations; and equipment or inventory, which can be more difficult to value and liquidate quickly.

The choice of collateral type depends on the nature of the loan and the borrower’s assets. For example, a business loan might use equipment or inventory as collateral, while a mortgage uses real estate. Personal property such as vehicles or jewelry can also serve as collateral, although their value may be more susceptible to depreciation.

Collateral Valuation for Credit Risk Assessment

Accurate valuation of collateral is critical for effective credit risk assessment. The valuation process aims to determine the market value of the collateral at the time of the loan application and periodically thereafter. This involves considering factors such as market conditions, the asset’s condition, and any encumbrances (e.g., existing liens). Several methods exist for valuing collateral, including market comparisons (assessing similar assets recently sold), income capitalization (estimating future income generated by the asset), and discounted cash flow analysis (projecting future cash flows and discounting them to present value).

The chosen method depends on the type of collateral and the availability of relevant data. Appraisals conducted by independent professionals are often required for high-value assets like real estate. For example, a bank appraising a house for a mortgage would use comparable sales data in the local market to estimate its value.

Examples of Collateral Reducing Credit Risk

Consider a small business seeking a loan to purchase new equipment. If the business pledges the equipment as collateral, the lender’s risk is reduced because, in case of default, they can repossess and sell the equipment to recover some or all of the loan amount. Similarly, a homeowner obtaining a mortgage secures the loan with their house. If the homeowner defaults, the lender can foreclose on the property and sell it to recoup losses.

These scenarios illustrate how collateral provides a tangible safety net, lowering the risk for lenders and potentially leading to more favorable loan terms for borrowers. A further example would be a secured credit card, where the cardholder provides collateral such as a savings account, reducing the lender’s risk and potentially allowing for a higher credit limit.

The Interplay of Credit Risk, Credit Score, and Credit Card

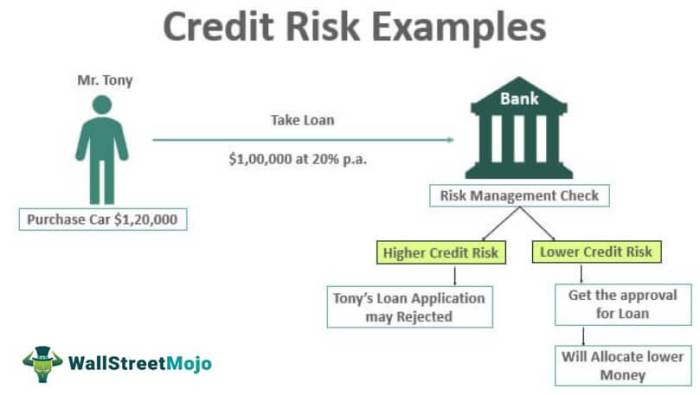

Credit cards are a ubiquitous part of modern finance, but their use is intrinsically linked to the concepts of credit risk and credit scores. Understanding this interplay is crucial for both consumers and lenders. Essentially, credit card issuers assess the creditworthiness of applicants to determine the level of risk involved in extending credit. This assessment heavily relies on credit scores and directly influences the terms of any credit card offered.Credit risk, credit score, and credit card issuance are inextricably linked.

Lenders use credit scores as a primary tool to quantify the risk of default. A higher credit score indicates a lower risk of default, while a lower score suggests a higher risk. This risk directly influences the lender’s decision to issue a credit card and the terms of that card, including the credit limit, interest rate, and any associated fees.

Credit Score Impact on Credit Card Access and Interest Rates

A poor credit score significantly limits access to credit cards. Individuals with low credit scores may be denied applications altogether or offered cards with extremely unfavorable terms. These unfavorable terms typically include high interest rates, low credit limits, and potentially high annual fees. For example, someone with a credit score below 600 might find it nearly impossible to obtain a standard credit card, and if they do, the interest rate might be significantly higher than that offered to someone with a score above 750.

This disparity reflects the increased risk perceived by the lender.

Credit Card Usage and its Effect on Credit Score

Responsible credit card usage is a key factor in building and maintaining a good credit score. Factors such as credit utilization (the percentage of available credit used), payment history (on-time payments versus late or missed payments), and the length of credit history all contribute to the calculation of a credit score. Consistent on-time payments, keeping credit utilization low (ideally below 30%), and maintaining a diverse range of credit accounts demonstrate financial responsibility and positively impact a credit score.

Conversely, consistently high credit utilization, missed payments, and applying for multiple credit cards in a short period can significantly damage a credit score.

Consequences of Poor Credit Card Management on Credit Risk

Poor credit card management directly translates to increased credit risk for lenders. Consistent late payments or defaults lead to a lower credit score, signaling a higher probability of future defaults. This higher risk increases the likelihood of the lender incurring losses. For instance, an individual with a history of missed payments might be deemed a high-risk borrower, leading to higher interest rates on future loans, difficulty securing loans or credit cards, and potentially impacting their ability to rent an apartment or purchase a car.

The cumulative effect of poor credit card management can significantly restrict financial opportunities and create a cycle of debt.

Successfully navigating the complexities of credit risk requires a holistic approach. By understanding the interplay between credit scores, financial health, collateral, and risk management strategies, lenders can make informed decisions, minimize losses, and foster a stable lending environment. This involves not only rigorous assessment techniques but also proactive strategies for mitigation and a commitment to robust risk management systems.

Ultimately, a comprehensive understanding of credit risk is essential for responsible and sustainable lending practices.

FAQ Insights

What is the difference between secured and unsecured loans?

Secured loans are backed by collateral (e.g., a house or car), reducing lender risk. Unsecured loans, like credit cards, are not backed by collateral, making them riskier for lenders and usually resulting in higher interest rates.

How can I improve my credit score?

Pay bills on time, keep credit utilization low (avoid maxing out credit cards), maintain a diverse credit history, and monitor your credit report for errors.

What are some common red flags in financial statements indicating high credit risk?

High debt-to-income ratio, declining revenue, significant increases in accounts payable, and consistent net losses are key red flags.

What is the impact of a bankruptcy on credit risk assessment?

Bankruptcy significantly impacts credit risk assessment. It indicates a history of financial distress and can result in difficulty obtaining future credit for many years.