Understanding and managing credit risk is paramount for financial institutions and lending businesses. Credit risk analysis tools are essential for navigating the complexities of assessing borrower creditworthiness and mitigating potential losses. These tools, ranging from simple scoring models to sophisticated statistical techniques, play a crucial role in informed lending decisions and overall financial stability. This guide explores the diverse landscape of credit risk analysis tools, examining their functionalities, applications, and the crucial role they play in responsible lending.

From fundamental credit scoring models like FICO and VantageScore to advanced statistical methods such as regression analysis and survival analysis, we delve into the mechanics of these tools, highlighting their strengths and limitations. We also address the importance of data quality and regulatory compliance in ensuring accurate and reliable risk assessments. This exploration aims to provide a comprehensive understanding of how these tools contribute to a robust and responsible credit risk management framework.

Introduction to Credit Risk Analysis Tools

Credit risk, the potential for borrowers to default on their financial obligations, is a significant concern for financial institutions. Effectively managing this risk is crucial for maintaining profitability and stability. Credit risk analysis tools are essential for mitigating this risk by providing sophisticated methods to assess and monitor the creditworthiness of borrowers and portfolios. These tools automate processes, enhance accuracy, and provide a deeper understanding of potential losses.Credit risk analysis tools encompass a wide range of methodologies and technologies designed to support various aspects of the credit decision-making process, from initial loan application assessment to ongoing portfolio monitoring.

The selection of appropriate tools depends on the specific needs and resources of the institution, as well as the complexity of its lending operations.

Types of Credit Risk Analysis Tools

The various tools available can be categorized based on their functionality and the users they serve. Some are designed for individual loan assessments, while others focus on portfolio-level risk management. Different tools utilize varying levels of sophistication, from simple scoring models to complex simulation techniques.

- Credit Scoring Models: These models use statistical techniques to assign a numerical score to borrowers based on their credit history and other relevant factors. Simpler models might use a limited number of variables, while more sophisticated models can incorporate hundreds of variables and complex algorithms. For example, a basic model might use only credit score and debt-to-income ratio, whereas a more advanced model might incorporate behavioral data, social media analysis, and alternative data sources.

- Credit Risk Rating Systems: These systems categorize borrowers into different risk classes based on their probability of default. These ratings are often used for internal decision-making and regulatory reporting. Internal ratings-based (IRB) approaches, for example, allow banks to use their own internal models to calculate risk-weighted assets for regulatory capital purposes. This requires significant expertise and validation by regulators.

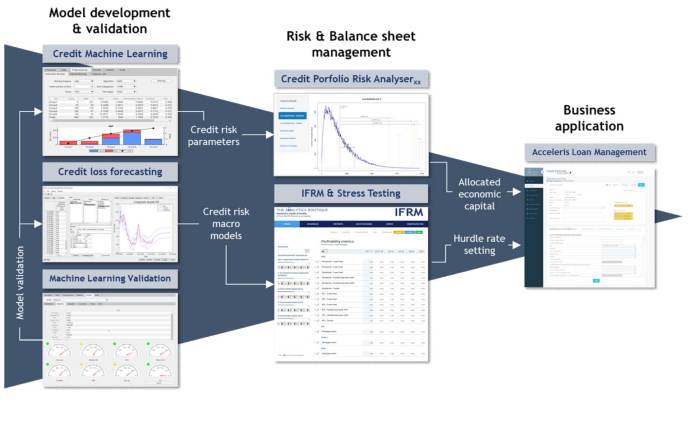

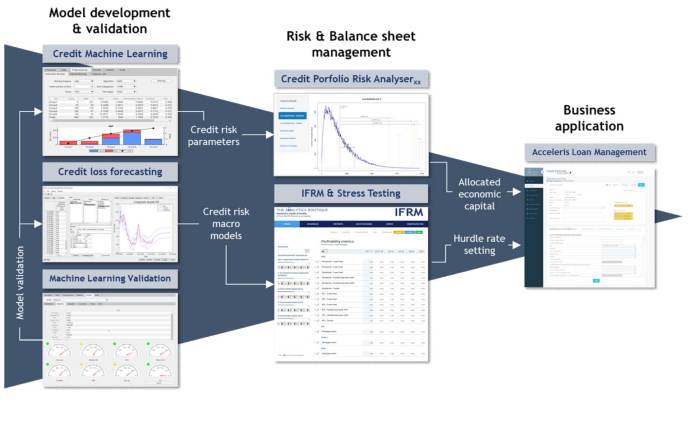

- Portfolio Management Tools: These tools provide a comprehensive view of a lender’s entire loan portfolio, allowing for the identification of concentrations of risk and the monitoring of overall portfolio performance. They often incorporate stress testing and scenario analysis capabilities, allowing institutions to assess the potential impact of adverse economic conditions on their portfolio.

- Advanced Analytics and Machine Learning: These techniques leverage large datasets and sophisticated algorithms to identify patterns and predict credit risk more accurately than traditional methods. Machine learning models can adapt to changing data and identify subtle relationships that might be missed by human analysts. For example, a machine learning model might be trained on historical loan data to predict the probability of default for new loan applications, incorporating factors that are difficult to quantify using traditional methods.

Benefits of Sophisticated Credit Risk Analysis Tools

Sophisticated credit risk analysis tools offer several advantages over simpler methods. These benefits ultimately contribute to better risk management, improved decision-making, and increased profitability.

- Enhanced Accuracy and Precision: Advanced statistical techniques and machine learning algorithms allow for more accurate predictions of credit risk compared to simpler, rule-based systems. This leads to better loan underwriting decisions and reduced losses from defaults.

- Improved Efficiency and Automation: Automation of various tasks, such as credit scoring and portfolio monitoring, frees up human analysts to focus on more complex issues. This increases efficiency and reduces operational costs.

- Better Risk Management: Sophisticated tools allow for more comprehensive risk assessment, including stress testing and scenario analysis, enabling institutions to better manage their exposure to credit risk.

- Data-Driven Decision Making: These tools provide data-driven insights into credit risk, allowing for more informed and objective decision-making. This minimizes biases and improves the overall quality of credit decisions.

Credit Scoring Models and Their Application

Credit scoring models are the backbone of modern lending decisions, providing a standardized way to assess the creditworthiness of individuals and businesses. These models utilize statistical techniques to analyze various data points and generate a numerical score that represents the likelihood of repayment. Understanding the mechanics and applications of these models is crucial for both lenders and borrowers.

Several models exist, each with its own methodology and weighting of factors. The most prominent are FICO and VantageScore, but numerous other proprietary and industry-specific models are also in use. These models are constantly evolving to incorporate new data sources and improve predictive accuracy. This evolution is necessary to keep pace with the changing economic landscape and evolving borrower behavior.

Credit Scoring Model Comparison

The following table compares three prominent credit scoring models: FICO, VantageScore, and a hypothetical example representing a more niche model. It’s important to note that specific scoring ranges and factor weightings can vary slightly depending on the specific version of the model used by a particular lender.

| Name | Scoring Range | Factors Considered | Strengths and Weaknesses |

|---|---|---|---|

| FICO Score | 300-850 | Payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), credit mix (10%) | Strengths: Widely accepted, robust methodology, extensive data history. Weaknesses: Can be sensitive to minor errors, may not fully capture nuances of individual financial situations. |

| VantageScore | 300-850 | Payment history, age and type of credit, amounts owed, available credit, new credit | Strengths: Incorporates more recent data, less sensitive to minor errors than some older FICO versions. Weaknesses: Less widely used than FICO, model variations can lead to inconsistencies. |

| Hypothetical Model (e.g., a model focused on small business lending) | 100-900 | Business revenue, profitability, debt-to-equity ratio, length of business operation, industry trends, personal credit score of the owner. | Strengths: Tailored to specific risk factors for small businesses. Weaknesses: Limited applicability outside of the target sector, may require more specialized data sources. |

The Role of Credit Scores in Lending Decisions and Risk Assessment

Credit scores are integral to the lending process, providing lenders with a quantitative assessment of a borrower’s creditworthiness. A higher score generally indicates a lower risk of default, leading to more favorable loan terms such as lower interest rates and higher loan amounts. Conversely, a lower score often results in higher interest rates, smaller loan amounts, or even loan rejection.

Lenders use credit scores alongside other factors, such as income and employment history, to make informed lending decisions. The specific weight given to the credit score can vary depending on the lender’s risk appetite and the type of loan.

Varying Risk Assessments from Different Credit Scoring Models

Different credit scoring models can produce varying risk assessments for the same applicant. This is because each model uses different algorithms, weights factors differently, and may incorporate different data sources. For example, one model might place a greater emphasis on payment history while another might give more weight to the age of credit accounts. This can lead to situations where an applicant receives a high score from one model and a lower score from another.

This highlights the importance of lenders considering multiple data points and not relying solely on a single credit score. Consider a scenario where an applicant has a history of paying bills on time but has only recently established credit. A model that heavily weighs payment history might give a relatively high score, while a model that emphasizes the length of credit history might give a lower score.

This difference could significantly impact the applicant’s access to credit and the terms offered.

Qualitative and Quantitative Credit Risk Assessment Methods

Credit risk assessment relies on a blend of qualitative and quantitative methods to provide a comprehensive understanding of a borrower’s creditworthiness. While both approaches aim to predict the likelihood of default, they differ significantly in their methodologies and the types of information they utilize. Understanding the strengths and weaknesses of each is crucial for making informed lending decisions.Qualitative and quantitative methods offer distinct perspectives on credit risk, and their combined use often yields the most accurate assessment.

Quantitative methods focus on numerical data and statistical analysis, while qualitative methods rely on subjective judgment and non-numerical information. The choice of which method, or combination of methods, to employ depends largely on the specific circumstances of the loan application and the available data.

Comparison of Qualitative and Quantitative Credit Risk Assessment Methods

The fundamental difference lies in the nature of the data used. Quantitative methods utilize numerical data to generate scores and probabilities, whereas qualitative methods rely on subjective assessments of factors that are difficult to quantify. This difference leads to distinct advantages and disadvantages for each approach.

- Quantitative Methods: These methods rely on statistical analysis of numerical data such as financial ratios, credit scores, and historical payment behavior. They aim to objectively assess the probability of default. Examples include:

- Credit scoring models: These models assign a numerical score based on various factors, providing a standardized measure of credit risk. FICO scores are a widely used example.

- Regression analysis: This statistical technique can be used to identify the relationship between various financial variables and the probability of default. For example, a bank might use regression to determine the relationship between loan-to-value ratio and default rate.

- Probability of default (PD) models: These models estimate the likelihood of a borrower defaulting on a loan based on historical data and statistical techniques.

- Qualitative Methods: These methods involve subjective judgments based on non-numerical information such as management experience, industry trends, and collateral quality. They aim to provide a more holistic assessment of the borrower’s creditworthiness. Examples include:

- Industry analysis: Assessing the overall health and stability of the borrower’s industry can provide insights into their potential for success or failure.

- Management assessment: Evaluating the experience, competence, and integrity of the borrower’s management team is crucial, especially for smaller businesses.

- Collateral evaluation: Determining the value and liquidity of the collateral offered by the borrower can mitigate the risk of loss in case of default. For example, evaluating the market value of real estate used as collateral.

Strengths and Limitations of Each Approach

Each method possesses inherent strengths and limitations that need to be considered.

- Quantitative Methods: Strengths: Objectivity, consistency, and ability to handle large datasets. Limitations: Oversimplification of complex situations, potential for bias in data selection, and inability to capture qualitative factors.

- Qualitative Methods: Strengths: Ability to capture nuanced information, consideration of non-quantifiable factors, and flexibility to adapt to unique situations. Limitations: Subjectivity, inconsistency across assessors, and difficulty in replicating findings.

Scenarios for Effective Application

The optimal approach depends heavily on the context.

- Quantitative methods are most effective for high-volume, standardized lending situations such as credit card applications or auto loans, where large datasets are available and consistent application of criteria is crucial. The efficiency and scalability of these methods make them ideal for mass processing.

- Qualitative methods are particularly valuable for assessing the creditworthiness of borrowers in complex or unique situations, such as large corporate loans or projects with significant uncertainties. The subjective judgment of experienced credit analysts can help navigate ambiguous situations and account for non-quantifiable factors.

Advanced Statistical Techniques in Credit Risk Modeling

Sophisticated statistical methods are crucial for accurate credit risk assessment, moving beyond basic scoring models to provide a more nuanced understanding of borrower default probabilities. These advanced techniques allow for the incorporation of complex relationships between variables and offer greater predictive power. This section will explore the application of regression analysis, logistic regression, and survival analysis in credit risk modeling.

Regression Analysis in Credit Risk Modeling

Regression analysis, particularly linear regression, helps model the relationship between a dependent variable (e.g., loan default amount) and one or more independent variables (e.g., loan amount, borrower income, credit score). The model aims to find the best-fitting line that describes this relationship, allowing for predictions of the dependent variable based on the independent variables. The inputs are the historical data on loan characteristics and outcomes.

The outputs include the regression coefficients, which represent the impact of each independent variable on the dependent variable, the R-squared value (measuring the goodness of fit), and the predicted default amounts. A key limitation is the assumption of linearity in the relationship between variables, which may not always hold true in real-world scenarios. For instance, a model might predict a linear relationship between loan amount and default amount, but in reality, the relationship might be more complex.

Furthermore, outliers in the data can significantly influence the results.

Logistic Regression in Credit Risk Modeling

Logistic regression is particularly well-suited for predicting the probability of a binary outcome, such as loan default (default or no default). Unlike linear regression, which predicts a continuous variable, logistic regression predicts the probability of an event occurring. The inputs are similar to linear regression, involving historical data on loan characteristics and default status. The output is the probability of default for a given set of borrower characteristics.

This probability is typically expressed as a number between 0 and 1. The model uses a logistic function to transform the linear combination of independent variables into a probability. Limitations include the assumption of a linear relationship between the log-odds of the outcome and the independent variables and the potential for multicollinearity among predictor variables, which can affect the stability and interpretation of the model’s coefficients.

For example, a logistic regression model could be used to predict the probability of a customer defaulting on a credit card based on their credit history, income, and spending habits.

Survival Analysis in Credit Risk Modeling

Survival analysis focuses on the time until an event occurs, such as loan default. It’s particularly useful when dealing with censored data, where the exact time of default is unknown for some borrowers (e.g., the loan is still active at the end of the observation period). The inputs include the time to default (or censoring) and relevant borrower characteristics.

The outputs include the survival function (the probability of not defaulting up to a given time), the hazard function (the instantaneous risk of default at a given time), and the estimated time to default. Different models exist within survival analysis, such as the Kaplan-Meier estimator and Cox proportional hazards model. A limitation is the assumption of proportional hazards in the Cox model, meaning the relative risk of default remains constant over time for different borrowers.

This might not always be true in practice. For example, a survival analysis model could be used to predict the probability of a mortgage default over a 30-year period, considering factors such as the borrower’s age, income, and initial loan-to-value ratio. The model would account for the fact that some borrowers may not default within the 30-year period.

Credit Card Credit Risk and Credit Score Interrelation

Credit cards, while offering convenience and financial flexibility, represent a significant aspect of an individual’s credit profile. The way individuals manage their credit card accounts directly impacts their credit risk assessment and, consequently, their credit scores. This interrelation is crucial for understanding how credit decisions are made by lenders.Credit card usage is intricately linked to credit risk assessment because it provides lenders with a window into an individual’s financial responsibility.

The data derived from credit card activity – such as payment history, credit utilization, and overall credit limit – is a key component of credit scoring models. Consistent on-time payments demonstrate responsible financial behavior, leading to a higher credit score. Conversely, missed or late payments, high credit utilization (the percentage of available credit used), and numerous credit inquiries (applications for new credit) are indicators of higher credit risk and result in lower credit scores.

Credit Card Behavior and Credit Score Impact

This section details how different credit card behaviors affect credit scores and subsequent loan applications. Consider two hypothetical individuals, Alex and Ben. Alex consistently pays his credit card bill in full and on time, maintaining a low credit utilization ratio (always below 30%). Ben, on the other hand, frequently makes late payments, carries a high balance, and applies for multiple credit cards within a short period.

As a result, Alex will have a significantly higher credit score than Ben. When Alex applies for a loan, he’ll likely qualify for a lower interest rate and more favorable terms due to his lower perceived risk. Ben, with his lower credit score, will likely face higher interest rates, stricter lending criteria, or even loan rejection. This illustrates how credit card management directly translates into tangible differences in loan approval and cost.

Factors Contributing to High Credit Card Risk

Several factors contribute to a higher credit risk associated with credit card usage. These factors are generally weighted differently in various credit scoring models, but their overall impact is significant. High credit utilization is a major factor; using a large portion of available credit suggests a potential inability to manage debt effectively. A history of late or missed payments is another critical indicator of poor financial responsibility.

Frequent applications for new credit demonstrate a need for additional credit, potentially signaling financial strain. Additionally, having multiple outstanding credit card accounts can increase risk, particularly if the balances are high. The length of credit history also matters; a shorter history provides less data for lenders to assess risk, often leading to a higher perceived risk. Finally, defaults or bankruptcies severely damage creditworthiness, drastically increasing the perceived risk associated with future credit applications.

Lenders meticulously consider these factors when assessing credit risk and determining creditworthiness.

Data Sources and Management for Credit Risk Analysis

Accurate credit risk assessment hinges on the quality and comprehensiveness of the data used. This section explores the diverse sources of data employed in credit risk analysis, emphasizing the critical role of data management in achieving reliable risk predictions. Effective data management ensures that the insights derived are trustworthy and actionable, leading to sound lending decisions.Data sources for credit risk analysis are broadly categorized as internal and external.

Internal data originates from within the lending institution itself, offering a detailed view of the borrower’s history and relationship with the lender. External data, on the other hand, provides a broader perspective, enriching the analysis with information not readily available internally.

Internal Data Sources

Internal data comprises a wealth of information directly related to a borrower’s interactions with the lending institution. This includes historical payment records, loan balances, credit limits, and details of any previous defaults or delinquencies. The data is typically structured and stored in databases, allowing for efficient retrieval and analysis. Furthermore, internal data can also include information gathered through customer relationship management (CRM) systems, providing insights into customer interactions, communication history, and overall account behavior.

The richness of internal data allows for a deep understanding of the borrower’s creditworthiness within the context of their relationship with the specific lender.

External Data Sources

External data significantly enhances the accuracy and comprehensiveness of credit risk assessments. These sources include credit bureaus (e.g., Equifax, Experian, TransUnion), which provide credit reports containing information on a borrower’s payment history, credit utilization, and public records. Other external data sources can include demographic data (e.g., age, location, income), public records (e.g., bankruptcies, judgments), and alternative data sources such as social media activity or transactional data from various service providers (with appropriate privacy considerations).

Accessing and integrating this external data expands the analytical perspective, leading to more nuanced risk assessments.

Data Quality and Management

Data quality is paramount in credit risk analysis. Inaccurate, incomplete, or inconsistent data can lead to flawed risk assessments and potentially significant financial losses. Data management practices must ensure data accuracy, completeness, consistency, and timeliness. This includes establishing robust data validation procedures, implementing data cleansing techniques, and regularly monitoring data quality metrics. Effective data governance frameworks are essential for maintaining data integrity and ensuring compliance with relevant regulations.

Example of Data Inconsistency Leading to Inaccurate Predictions

Consider a scenario where a bank uses a credit scoring model that relies heavily on payment history. If the payment history data contains inconsistencies – for instance, some payments are recorded as late while others are not, due to data entry errors or system glitches – the model may misclassify a borrower’s risk profile. A borrower with a consistently good payment history might be incorrectly flagged as high-risk, leading to an unjustified loan denial or a higher interest rate.

Conversely, a borrower with a poor payment history might be underestimated, resulting in increased risk for the lender.

Best Practices for Data Management in Credit Risk Analysis

Effective data management is crucial for accurate risk assessment. The following best practices contribute to achieving this goal:

- Establish Data Governance Framework: Define clear roles, responsibilities, and processes for data management.

- Implement Data Quality Controls: Regularly validate and cleanse data to ensure accuracy and consistency.

- Utilize Data Profiling Techniques: Analyze data characteristics to identify potential inconsistencies and anomalies.

- Maintain Data Security and Privacy: Implement robust security measures to protect sensitive borrower information.

- Regularly Update and Refresh Data: Incorporate new data sources and update existing data to maintain accuracy and relevance.

- Document Data Sources and Processes: Maintain detailed documentation of data sources, transformations, and analytical methodologies.

- Employ Data Visualization Techniques: Utilize charts and graphs to effectively communicate data insights and identify patterns.

Regulatory Compliance and Credit Risk Management

Effective credit risk management is not merely a best practice; it’s a legal and regulatory imperative. Financial institutions worldwide face a complex web of regulations designed to protect consumers, maintain financial stability, and prevent systemic risk. These regulations dictate how institutions assess, measure, monitor, and report on their credit risk exposures. Failure to comply can result in significant penalties, reputational damage, and even insolvency.The impact of regulatory changes on credit risk analysis tools is profound.

New regulations often necessitate the development of more sophisticated tools and methodologies to meet the enhanced reporting and disclosure requirements. This can involve significant investment in technology, data infrastructure, and skilled personnel. Furthermore, regulatory changes frequently force institutions to reassess their existing risk appetite and adjust their credit risk management strategies accordingly. For example, the introduction of Basel III accords significantly impacted the way banks calculate their capital requirements, leading to a widespread adoption of more advanced credit risk models and internal ratings systems.

Regulatory Requirements for Credit Risk Management and Reporting

Regulations related to credit risk management and reporting vary considerably depending on the jurisdiction and the type of financial institution. However, common themes include requirements for robust risk assessment methodologies, comprehensive data collection and reporting, effective internal controls, and independent oversight. Specific regulations often focus on areas such as capital adequacy, loan loss provisioning, stress testing, and disclosure of credit risk exposures to investors and regulators.

These requirements aim to ensure that institutions have a clear understanding of their credit risk profile and are adequately capitalized to absorb potential losses. Non-compliance can lead to fines, restrictions on operations, or even the revocation of a license. For instance, the Dodd-Frank Act in the United States introduced stricter regulations on financial institutions, requiring enhanced risk management practices and increased transparency.

Impact of Regulatory Changes on Credit Risk Analysis Tools

Regulatory changes often drive innovation in credit risk analysis tools. As regulatory requirements become more stringent, institutions are compelled to adopt more sophisticated tools and techniques to meet these demands. This has led to the increased use of advanced statistical modeling, machine learning, and big data analytics in credit risk management. For example, the increasing emphasis on stress testing has spurred the development of more sophisticated scenario analysis tools that can simulate a wider range of economic conditions.

Similarly, regulations requiring more granular reporting of credit risk exposures have driven the development of improved data management and reporting systems. The shift towards more granular data requirements necessitates investment in better data collection and processing capabilities.

Key Regulatory Bodies and Guidelines

Understanding the key regulatory bodies and their guidelines is crucial for effective credit risk management. Compliance with these regulations is not optional; it’s a fundamental requirement for operating in the financial services industry.

- Basel Committee on Banking Supervision (BCBS): Develops international standards for banking supervision, including guidelines on capital adequacy, risk management, and stress testing. Their Basel Accords significantly influence credit risk management practices globally.

- European Banking Authority (EBA): Sets standards and provides guidelines for banking supervision within the European Union. Their regulations cover a wide range of areas, including credit risk, capital requirements, and recovery and resolution planning.

- Office of the Comptroller of the Currency (OCC) (USA): Supervises and regulates national banks in the United States. Their regulations cover various aspects of banking operations, including credit risk management, lending practices, and consumer protection.

- Federal Reserve System (FED) (USA): Oversees the U.S. banking system and plays a critical role in setting monetary policy. Their regulations influence credit risk management practices, particularly through their supervision of bank holding companies and their influence on capital requirements.

- Financial Conduct Authority (FCA) (UK): Regulates financial services in the United Kingdom, including the credit risk management practices of banks and other financial institutions. Their regulations focus on consumer protection, market integrity, and the stability of the financial system.

Effective credit risk analysis is not merely a technical exercise; it’s a critical component of responsible lending and financial stability. The tools and methodologies discussed herein, from basic credit scoring to advanced statistical modeling, provide a framework for mitigating risk and making informed lending decisions. By understanding the nuances of each approach, and by prioritizing data quality and regulatory compliance, financial institutions can significantly enhance their ability to manage credit risk effectively, contributing to a healthier and more resilient financial ecosystem.

Query Resolution

What is the difference between FICO and VantageScore?

While both are credit scoring models, they use different algorithms and weighting of factors. FICO is more widely used, and VantageScore incorporates more recent data and potentially considers different factors.

How often are credit scores updated?

Credit scores are typically updated several times a month, reflecting changes in credit behavior. However, the frequency depends on the reporting agency and individual activity.

Can I improve my credit score?

Yes, paying bills on time, keeping credit utilization low, and maintaining a diverse credit history are key factors in improving your credit score.

What are the legal implications of inaccurate credit risk assessments?

Inaccurate assessments can lead to legal challenges, including discrimination lawsuits and regulatory penalties. Strict adherence to fair lending practices and data accuracy is essential.