Mastering your finances starts with understanding your credit score. Credit score tracking apps offer a convenient and efficient way to monitor this crucial number, providing insights into your financial health and empowering you to make informed decisions. This guide explores the best apps available, highlighting key features, security measures, and strategies for improvement.

From understanding the factors influencing your score to learning how to interpret the data presented by these apps, we’ll equip you with the knowledge to confidently navigate the world of credit scoring and optimize your financial well-being. We’ll delve into the advantages of app-based tracking compared to manual methods, emphasizing the convenience and readily available insights these apps provide.

Introduction to Credit Score Tracking Apps

Maintaining a healthy credit score is crucial for securing favorable financial terms on loans, mortgages, and even some rental agreements. A strong credit score reflects responsible financial behavior and can significantly impact your financial well-being. Regularly monitoring your credit score allows you to identify and address any potential issues promptly, preventing them from negatively impacting your financial future.Understanding and tracking your credit score empowers you to make informed financial decisions.

Consistent monitoring provides valuable insights into your creditworthiness, enabling proactive adjustments to improve your financial standing. This proactive approach can save you considerable time and money in the long run.

Reasons for Tracking Credit Scores

Regularly reviewing your credit report and score offers numerous advantages. Ignoring your credit health can lead to missed opportunities and potentially costly mistakes. Consistent monitoring allows for early detection of errors and fraudulent activity, ensuring your financial security.

- Early Detection of Errors: Inaccuracies on your credit report can significantly lower your score. Regular monitoring allows you to identify and dispute these errors quickly, preventing a potential drop in your score.

- Fraudulent Activity Prevention: Credit score tracking apps often provide alerts for suspicious activity, such as new accounts opened in your name without your authorization. Early detection allows you to take immediate action to prevent further damage.

- Improved Financial Planning: Understanding your credit score helps you set realistic financial goals. You can make informed decisions about borrowing, budgeting, and saving, leading to better overall financial health.

Benefits of Credit Score Tracking Apps over Manual Methods

While manually checking your credit score is possible, credit score tracking apps offer several significant advantages. These apps provide convenient, automated monitoring and offer features that make credit management more efficient and user-friendly. The convenience and features of these apps outweigh the effort of manual checking.

- Convenience and Automation: Apps automatically track your score and alert you to significant changes, eliminating the need for manual checking and reducing the likelihood of missing crucial updates. For example, many apps will send you a notification if your score changes by a certain number of points.

- Comprehensive Reporting: Many apps provide more than just your credit score. They often include details about your credit utilization, payment history, and other factors influencing your score, offering a holistic view of your credit health. This detailed information helps you understand what factors are positively or negatively affecting your credit score, allowing for targeted improvements.

- User-Friendly Interface: These apps are designed for ease of use, providing clear and concise information in an easily digestible format. Unlike navigating complex credit report websites, apps offer a simplified and streamlined experience. The information is presented in a way that’s easy to understand, even for those unfamiliar with credit scoring.

Key Features of Top Credit Score Apps

Choosing the right credit score tracking app can significantly simplify the process of monitoring your financial health. Many apps offer similar core functionalities, but subtle differences in features and presentation can greatly impact the user experience. Understanding these key distinctions is crucial for selecting the best app to meet your individual needs.

Several essential features consistently appear in top-rated credit score tracking apps. These features contribute to a comprehensive and user-friendly experience, enabling effective credit monitoring and management.

Essential Features of Top Credit Score Apps

Five key features frequently found in high-ranking credit score apps are: access to all three major credit bureaus’ scores, credit report monitoring for suspicious activity, personalized financial advice and tips, secure data encryption and protection, and user-friendly interface and navigation. The combination of these features provides a robust and helpful tool for users.

User Interface Comparisons Across Popular Apps

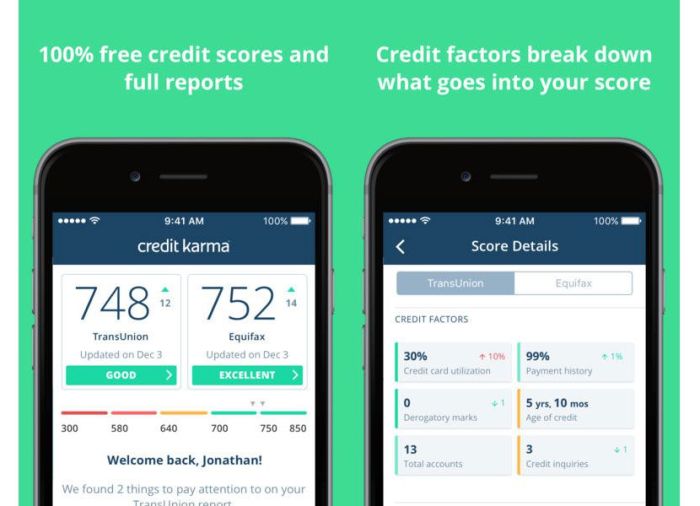

The user interface (UI) significantly influences the user experience. Three popular apps—Credit Karma, Experian, and Mint—offer distinct approaches to presenting credit information. Credit Karma prioritizes a clean, minimalist design, focusing on clear score display and actionable insights. Experian’s app tends to be more detailed, providing a wealth of information but potentially overwhelming new users. Mint, known for its comprehensive financial management tools, integrates credit scores seamlessly into its broader financial overview.

This integration can be advantageous for users who manage multiple financial accounts within Mint.

Data Presentation Styles in Credit Score Apps

Different apps employ various methods to present credit score data. This affects how easily users can understand and interpret their information. Some apps primarily use graphs and charts to visualize score trends over time, while others rely more heavily on tables and numerical data. The choice of presentation style influences user comprehension and engagement.

| App | Score Presentation | Trend Visualization | Additional Data Presentation |

|---|---|---|---|

| Credit Karma | Large, prominent score display | Clear line graph showing score changes over time | Bullet points summarizing key factors influencing the score |

| Experian | Detailed score breakdown by factor | Bar charts comparing individual factors to national averages | Tables summarizing credit utilization and payment history |

| Mint | Score integrated within overall financial dashboard | Simple graph showing score trend | Summary of key financial metrics alongside credit score |

Data Accuracy and Security in Credit Score Apps

Credit score apps rely on the accuracy of the data they present and the security of the user information they handle. Maintaining both is crucial for the app’s effectiveness and the user’s financial well-being. A lack of accuracy can lead to poor financial decisions, while a security breach could expose sensitive personal data to malicious actors.Data accuracy and security are intertwined; robust security measures are essential to maintain data accuracy by preventing unauthorized access and modification.

Apps employ various strategies to achieve both, including data encryption, multi-factor authentication, and regular security audits.

Data Accuracy Methods

Credit score apps typically obtain credit information directly from the three major credit bureaus (Equifax, Experian, and TransUnion). The accuracy of the data depends heavily on the accuracy of the information reported to these bureaus by lenders and other creditors. Apps often employ automated systems to compare data from different sources, flagging discrepancies for manual review. This process helps identify and correct errors, improving the overall accuracy of the reported credit score.

Some apps also offer tools to help users dispute inaccuracies directly with the credit bureaus, further ensuring the data’s reliability. While the apps strive for accuracy, users should remember that the underlying data originates from the credit bureaus and might contain errors.

Security Measures Implemented

Protecting user data is paramount. Credit score apps employ a range of security measures, including data encryption both in transit and at rest, strong password requirements, and multi-factor authentication (MFA). Data encryption transforms data into an unreadable format, making it incomprehensible to unauthorized individuals even if intercepted. Strong password policies ensure users choose complex passwords, while MFA adds an extra layer of security by requiring verification through a second method, such as a code sent to a mobile phone or email.

Regular security audits and penetration testing help identify and address vulnerabilities before they can be exploited. Furthermore, many apps comply with industry standards such as PCI DSS (Payment Card Industry Data Security Standard) where applicable, demonstrating a commitment to data protection.

Hypothetical Security Breach Scenario and Consequences

Imagine a scenario where a credit score app suffers a data breach due to a vulnerability in its security system. A malicious actor gains unauthorized access to the app’s database, obtaining sensitive user information including names, addresses, Social Security numbers, and credit scores. The consequences could be severe. Users could become victims of identity theft, with the perpetrator using their stolen information to open fraudulent accounts, apply for loans, or make unauthorized purchases.

The app’s reputation would suffer significantly, potentially leading to legal action and financial losses. Furthermore, the breach could erode user trust, causing a decline in the app’s user base. This hypothetical scenario highlights the critical importance of robust security measures for credit score apps.

Credit Score Factors and Their Impact

Your credit score, a crucial number impacting your financial life, isn’t randomly assigned. It’s a reflection of your creditworthiness, calculated using a specific formula based on several key factors. Understanding these factors and their influence allows you to proactively manage your credit and improve your score over time. This section details the major components of your credit score and provides examples of how they affect your overall rating.

Lenders use your credit score to assess the risk associated with lending you money. A higher credit score typically translates to better interest rates on loans, lower insurance premiums, and easier access to credit. Conversely, a low credit score can significantly limit your financial opportunities.

Payment History

Payment history is the most significant factor influencing your credit score, accounting for approximately 35% of the FICO score calculation. This section focuses on the importance of consistent on-time payments.

- Positive Impact: Consistently paying all your bills on time, including credit cards, loans, and mortgages, demonstrates responsible financial behavior and significantly boosts your credit score. For example, someone with a perfect payment history for five years will have a substantially higher score than someone with several late payments.

- Negative Impact: Even one missed payment can negatively impact your score. Multiple late payments or defaults severely damage your creditworthiness. For instance, a single 30-day late payment on a credit card can drop your score by several points, while repeated late payments can cause a much more significant decline.

Amounts Owed

This factor, representing approximately 30% of your FICO score, examines how much debt you have relative to your available credit. This section explains the concept of credit utilization and its effects.

- Positive Impact: Keeping your credit utilization low (ideally below 30%) shows responsible credit management. For example, if you have a credit card with a $1000 limit, keeping your balance below $300 will positively impact your score.

- Negative Impact: High credit utilization, meaning you’re using a large portion of your available credit, signals higher risk to lenders. Using more than 70% of your available credit can significantly lower your score. For example, carrying a balance of $800 on a $1000 credit card would be considered high utilization.

Length of Credit History

The length of your credit history, accounting for approximately 15% of your FICO score, reflects the duration you’ve had credit accounts open. This section details the importance of maintaining long-standing credit accounts.

- Positive Impact: A long and consistent credit history demonstrates a track record of responsible credit management. Having credit accounts open for many years, without any major negative marks, will contribute to a higher score. For instance, an individual with credit accounts open for 10+ years will generally have a higher score than someone with only a few years of credit history.

- Negative Impact: Closing old accounts, especially those with a long history of on-time payments, can shorten your credit history and negatively impact your score. This is because the average age of your accounts is a factor in your score calculation.

New Credit

This factor, representing approximately 10% of your FICO score, considers how frequently you apply for new credit. This section emphasizes the impact of multiple credit applications.

- Positive Impact: Applying for credit infrequently demonstrates responsible behavior. A steady credit history with minimal new credit applications suggests lower risk to lenders.

- Negative Impact: Applying for multiple credit accounts in a short period can lower your score. Each application results in a “hard inquiry” on your credit report, which can temporarily lower your score. For example, applying for five credit cards within a month will negatively impact your score more than applying for one credit card every year.

Credit Mix

Credit mix, accounting for approximately 10% of your FICO score, refers to the variety of credit accounts you possess. This section highlights the benefits of a diversified credit portfolio.

- Positive Impact: Having a mix of different credit accounts, such as credit cards, installment loans (like auto loans or mortgages), and other forms of credit, can demonstrate responsible management of various credit types. For example, having a mix of credit cards and a mortgage shows lenders you can handle different types of credit responsibly.

- Negative Impact: Having only one type of credit account, such as only credit cards, might not show the full picture of your creditworthiness to lenders. While not necessarily negative, a diverse credit mix generally results in a higher score.

Choosing the Right Credit Score App

Selecting the right credit score tracking app can significantly improve your financial management. The abundance of options available can be overwhelming, but a methodical approach ensures you choose an app that meets your specific needs and enhances your understanding of your credit health. Consider your credit knowledge, desired features, and budget when making your selection.

Choosing the right credit score app involves a systematic process. A step-by-step guide, combined with a decision tree, clarifies the decision-making process, allowing you to select an app that aligns perfectly with your individual circumstances and financial goals.

Step-by-Step Guide to Selecting a Credit Score App

This guide provides a structured approach to selecting a suitable credit score tracking app. Following these steps will help you navigate the available options and choose the best fit for your needs.

- Assess Your Credit Knowledge: Determine your current level of understanding regarding credit scores, reports, and related financial concepts. Beginners might benefit from apps with educational resources, while experienced users might prioritize advanced features.

- Identify Your Needs: Consider the features you require. Do you need basic score tracking, detailed report analysis, or budgeting tools? A clear understanding of your needs will narrow down the options.

- Compare App Features: Once you’ve identified your needs, compare the features of several apps. Look for features like score updates, credit report access, alerts for significant changes, and educational resources.

- Check Reviews and Ratings: Examine user reviews and ratings on app stores to gauge the overall user experience and identify any potential issues with accuracy or functionality.

- Review Privacy Policies: Pay close attention to the app’s privacy policy to understand how your data is collected, used, and protected. Choose an app with robust security measures.

- Consider the Cost: Many apps offer free basic features, while others charge subscription fees for premium access. Weigh the cost against the value of the features offered.

- Test the App (if possible): Many apps offer free trials or limited free access. Take advantage of these opportunities to test the app’s functionality and user interface before committing to a subscription.

Decision Tree for Credit Score App Selection

This decision tree visually represents the selection process, guiding you through a series of questions to help you determine the most suitable app for your situation.

Imagine a tree with branches. The first branch is “Credit Knowledge Level”. This splits into “Beginner”, “Intermediate”, and “Advanced”. Each of these branches then splits further based on the desired features: “Basic Score Tracking”, “Detailed Report Analysis”, “Budgeting Tools”, and “Other Advanced Features”. The final branches represent specific apps that best fit the chosen path.

For example, a beginner who only needs basic score tracking might end up with a simple, free app, while an advanced user needing detailed analysis and budgeting tools might choose a paid app with more comprehensive features. The specific apps at the end of the branches would be named according to their features and suitability.

Considerations for Users with Different Credit Knowledge Levels

The choice of credit score app should align with the user’s level of financial literacy. Different apps cater to various levels of expertise.

Beginner Users: Beginners benefit from apps with clear explanations of credit scores, reports, and related concepts. Apps offering educational resources and simplified interfaces are ideal. They might prioritize apps that clearly display their credit score and provide basic insights without overwhelming technical details.

Intermediate Users: Intermediate users are comfortable with basic credit concepts but seek more in-depth analysis. They may look for apps that offer detailed credit report information, score simulations, and tools to identify areas for improvement. They may appreciate features that track credit utilization or provide personalized recommendations for improving their credit score.

Advanced Users: Advanced users possess a strong understanding of credit and seek sophisticated tools for managing their finances. They might prioritize apps with advanced features such as credit score simulations based on various scenarios, in-depth analysis of credit report elements, and integration with other financial management tools. They are likely comfortable interpreting complex data and using the information to make strategic financial decisions.

Improving Credit Scores Through App Usage

Credit score tracking apps offer more than just a numerical snapshot of your financial health; they provide valuable tools and insights to actively improve your creditworthiness. By understanding and utilizing the features these apps offer, you can take concrete steps towards a better credit score and a more secure financial future. Consistent monitoring and strategic action, guided by your app’s data, are key to success.Many apps provide personalized recommendations based on your credit report.

These recommendations are often accompanied by educational materials explaining the impact of different financial behaviors on your credit score. This combination of data visualization and practical advice empowers users to make informed decisions that directly contribute to score improvement.

Understanding and Addressing Negative Factors

Credit score apps often highlight negative factors impacting your score, such as late payments, high credit utilization, or a history of bankruptcies. By pinpointing these areas, the app helps you focus your efforts on the most impactful improvements. For example, if the app shows a high credit utilization ratio, you can actively work towards reducing it by paying down existing debts.

Similarly, if late payments are a recurring issue, the app can help you set up payment reminders to avoid future negative marks.

Utilizing App Features for Positive Change

Many apps provide features that directly support credit score improvement. These may include budgeting tools to help manage spending and avoid accumulating debt, debt repayment calculators to determine the most efficient strategies for paying down balances, and alerts for upcoming payments to ensure timely settlements. These features, when used consistently, can significantly contribute to a healthier credit profile.

Actionable Steps for Credit Score Improvement

Understanding how your credit score is calculated is crucial. Many apps provide this information, breaking down the various components—payment history, amounts owed, length of credit history, new credit, and credit mix—and showing their relative weight in your overall score. This granular level of detail allows for targeted improvements.

- Set up payment reminders: Apps often allow you to schedule alerts for upcoming bill payments, minimizing the risk of late payments, a major factor impacting your score.

- Reduce credit utilization: Monitor your credit utilization ratio (the percentage of available credit you’re using) and aim to keep it below 30%. Apps provide this information and can help you track progress towards this goal.

- Pay down high-interest debt: Focus on paying down debt with the highest interest rates first. Some apps offer debt repayment calculators to help you strategize and prioritize.

- Avoid opening multiple new credit accounts: Opening too many new accounts in a short period can negatively impact your score. Track your credit applications through the app to avoid excessive inquiries.

- Maintain a positive payment history: Consistent on-time payments are the most significant factor influencing your credit score. Utilize app reminders to ensure timely payments.

Potential Drawbacks of Credit Score Apps

While credit score tracking apps offer significant benefits, it’s crucial to acknowledge their potential limitations. These apps, while convenient, are not without drawbacks that users should understand to utilize them effectively and responsibly. Failing to do so could lead to misunderstandings about your credit health or even compromise your personal information.Understanding the potential pitfalls of these apps is key to leveraging their advantages without falling prey to their shortcomings.

This involves careful consideration of data accuracy, security concerns, and the ethical implications of sharing sensitive financial information.

Data Accuracy and Discrepancies

Credit score apps typically pull data from one or more of the three major credit bureaus (Equifax, Experian, and TransUnion). However, the scores presented might not perfectly reflect the data held by all three bureaus. Discrepancies can arise due to timing differences in data updates, or because the app may only use data from a single bureau, presenting an incomplete picture of your overall credit health.

This could lead to inaccurate assessments of your creditworthiness. For example, a user might see a higher score on one app than another, causing confusion and potentially leading to incorrect financial decisions. Always cross-reference the information provided by the app with your official credit reports from each bureau to ensure accuracy.

Data Security and Privacy Risks

Sharing sensitive financial data with a third-party app inherently carries risks. Data breaches, while hopefully rare, are a possibility. A compromised app could expose your personal information, including your Social Security number, address, and credit history, making you vulnerable to identity theft or fraud. Carefully review the app’s privacy policy and security measures before granting access to your financial data.

Choose apps with strong security protocols and a proven track record of protecting user information. Consider the potential consequences of a data breach and the steps you would take to mitigate the damage should it occur.

Ethical Considerations and Data Usage

Many credit score apps generate revenue through advertising or by selling aggregated, anonymized user data. While this may not directly affect individual users, it raises ethical concerns regarding data privacy and the potential for misuse of personal information. Understand how the app uses your data and whether it shares this information with third parties. Prioritize apps with transparent data usage policies and strong commitments to user privacy.

It is important to be aware that even anonymized data can sometimes be re-identified, so caution is always warranted.

Ultimately, choosing the right credit score tracking app depends on individual needs and preferences. By carefully considering the features, security measures, and data presentation styles, you can find a tool that empowers you to actively manage and improve your credit score. Remember to always verify app information with official credit reports and practice responsible credit card management for optimal financial health.

FAQ Compilation

What if an app shows a different score than my official credit report?

Discrepancies can occur. Always prioritize information from your official credit reports from Equifax, Experian, and TransUnion. App scores are often based on VantageScore, which may differ from FICO scores used by lenders.

Are credit score apps free?

Some apps offer basic features for free, while others charge a subscription fee for premium access to more detailed information and features. Carefully review pricing before subscribing.

How often should I check my credit score?

Checking your credit score regularly, ideally monthly, allows you to monitor for any changes or potential issues. This proactive approach helps you address problems early.

Can I use these apps to dispute inaccurate information on my credit report?

While many apps provide tools to flag potential inaccuracies, you’ll usually need to directly contact the credit bureaus (Equifax, Experian, and TransUnion) to formally dispute any errors.