Building a strong credit score is crucial for financial well-being, impacting everything from loan approvals to insurance rates. Credit cards, while potentially risky, offer a powerful tool for improving your score if used responsibly. This guide explores the best credit card options for credit score enhancement, emphasizing responsible usage and strategies for maximizing their positive impact.

We’ll delve into different credit card types – secured, unsecured, and student cards – comparing their features and suitability for building credit. Understanding the factors influencing credit scores, such as payment history and credit utilization, is key to success. We will also discuss responsible credit card management techniques, including budgeting, debt management strategies, and the importance of monitoring your credit report regularly.

By following the advice Artikeld here, you can effectively leverage credit cards to improve your financial standing.

Understanding Credit Scores and Credit Cards

A credit score is a three-digit number that represents your creditworthiness. Lenders use it to assess the risk of lending you money. A higher credit score generally means you’re considered a lower risk, leading to better interest rates and loan terms on mortgages, auto loans, and even credit cards. Conversely, a low credit score can significantly limit your borrowing options and result in higher interest rates.Using credit cards strategically can be a powerful tool for improving your credit score.

Responsible credit card management demonstrates to lenders your ability to handle debt responsibly. This, in turn, positively impacts your credit score. However, misuse can have the opposite effect, potentially damaging your credit rating.

Factors Influencing Credit Scores

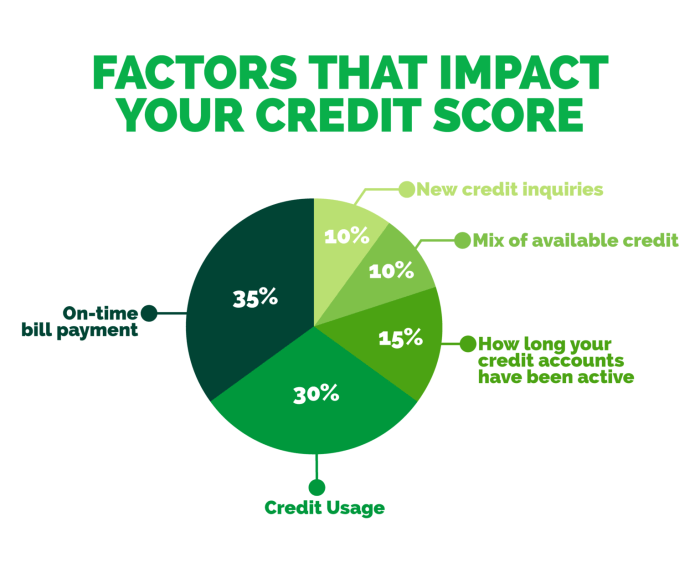

Your credit score is calculated using a complex formula, but several key factors heavily influence the final number. Understanding these factors is crucial for effectively improving your credit score. These factors are typically weighted differently by different credit scoring models, but all are significant.

- Payment History: This is the most significant factor, accounting for approximately 35% of your credit score. Consistent on-time payments demonstrate responsible financial behavior. Even one missed payment can negatively impact your score. Conversely, a long history of on-time payments significantly boosts your score.

- Amounts Owed: This factor, representing about 30% of your score, refers to the amount of credit you’re currently using compared to your total available credit. Maintaining a low credit utilization ratio (the percentage of your available credit that you’re using) is crucial. Ideally, aim to keep your credit utilization below 30%, and preferably even lower. For example, if you have a $1000 credit limit, try to keep your balance below $300.

- Length of Credit History: The length of your credit history accounts for approximately 15% of your credit score. A longer history of responsible credit use shows lenders that you’ve consistently managed credit well over time. This is why it’s beneficial to keep older accounts open, even if you’re not actively using them, provided they’re in good standing.

- Credit Mix: This factor, contributing approximately 10% to your score, refers to the variety of credit accounts you have. Having a mix of credit cards, installment loans (like auto loans or mortgages), and other credit accounts demonstrates your ability to manage different types of credit responsibly.

- New Credit: This factor accounts for about 10% of your credit score and considers how many new credit accounts you’ve opened recently. Opening several new accounts in a short period can negatively impact your score, as it suggests increased risk to lenders. It’s generally recommended to limit applications for new credit to only when truly needed.

Types of Credit Cards for Credit Score Building

Choosing the right credit card can significantly impact your credit score journey. Understanding the different types available and their features is crucial for building a positive credit history. This section will explore the key categories of credit cards and their respective advantages and disadvantages for credit score improvement.

Several credit card types cater specifically to individuals aiming to establish or improve their credit. The most common include secured credit cards, unsecured credit cards, and student credit cards. Each offers a unique set of features and requirements, making it essential to carefully consider your financial situation and credit history before applying.

Secured Credit Cards

Secured credit cards require a security deposit, which typically becomes your credit limit. This deposit mitigates the risk for the issuer, making them accessible even to individuals with limited or damaged credit. The benefits include guaranteed approval, the ability to build credit history, and the opportunity to graduate to an unsecured card once a positive payment history is established.

However, drawbacks include the need for a security deposit and potentially lower credit limits compared to unsecured cards. Consistent on-time payments on a secured card demonstrate responsible credit behavior, positively impacting your credit score over time.

Unsecured Credit Cards

Unsecured credit cards do not require a security deposit. Approval depends on your creditworthiness, including your credit score, income, and debt-to-income ratio. These cards generally offer higher credit limits and better rewards programs than secured cards. The benefits include higher credit limits, potentially better rewards, and the ability to build credit more rapidly with responsible use. The drawbacks are that approval is not guaranteed, and a poor credit history can lead to rejection or higher interest rates.

Successfully managing an unsecured card shows lenders you can handle credit responsibly, leading to a better credit score.

Student Credit Cards

Designed specifically for students, these cards often have lower credit limits and may offer features like educational benefits or rewards programs tailored to students. Many student credit cards are unsecured, but some may require a co-signer to improve the chances of approval. The advantages include building credit history while in school, access to financial tools and resources, and potentially lower interest rates or fees compared to other unsecured cards.

The disadvantages include potentially lower credit limits, and the need for a co-signer in some cases. Responsible use of a student credit card can help establish a positive credit history early on, paving the way for better credit opportunities in the future.

Comparison of Credit Card Types

The following table compares four common credit card types, highlighting key differences that influence credit score building.

| Card Type | APR (Approximate Range) | Annual Fee | Credit Limit Requirements |

|---|---|---|---|

| Secured Credit Card | 18-25% | $0 – $50 (often waived) | Equal to security deposit |

| Unsecured Credit Card (Good Credit) | 12-18% | $0 – $100+ | Varies greatly based on credit score; potentially higher |

| Unsecured Credit Card (Fair Credit) | 20-30% | $0 – $100+ | Lower than for good credit; may be subject to stricter approval |

| Student Credit Card | 15-25% | $0 – $50 (often waived) | Generally low, often increasing over time with responsible use |

Responsible Credit Card Usage for Score Improvement

Building a strong credit score requires more than just obtaining a credit card; it necessitates responsible usage. Understanding and implementing best practices ensures you leverage your credit card to improve your financial standing, rather than harming it. Consistent responsible behavior positively impacts your creditworthiness, paving the way for better financial opportunities in the future.

Responsible credit card use centers around managing your spending and payments diligently. This involves careful budgeting, timely payments, and maintaining a low credit utilization ratio. Conversely, irresponsible behavior – such as missed payments, high balances, and frequent applications – can significantly damage your credit score, potentially leading to higher interest rates and limited access to credit.

Best Practices for Responsible Credit Card Use

Several key strategies contribute to building a positive credit history. Adhering to these practices demonstrates financial responsibility to lenders, resulting in a higher credit score.

- Pay on Time, Every Time: Payment history is the most crucial factor influencing your credit score. Even a single missed payment can negatively impact your score. Set up automatic payments or reminders to ensure timely payments.

- Keep Credit Utilization Low: Credit utilization is the percentage of your available credit that you’re using. Aim to keep this below 30%, ideally below 10%. A high utilization ratio signals to lenders that you may be overextended financially.

- Monitor Your Credit Report Regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) annually to identify and address any errors or fraudulent activity. Early detection is crucial for maintaining a healthy credit score.

- Limit New Credit Applications: Each time you apply for a new credit account, a hard inquiry is placed on your credit report, which can temporarily lower your score. Only apply for credit when necessary.

- Maintain a Mix of Credit Accounts: While not as impactful as payment history and utilization, having a mix of credit accounts (e.g., credit cards and installment loans) can demonstrate a broader range of credit management skills.

Consequences of Irresponsible Credit Card Usage

Failing to manage credit cards responsibly can have serious repercussions, significantly impacting your financial well-being and future opportunities.

- Lower Credit Score: Missed payments, high utilization, and numerous credit applications directly lead to a lower credit score, limiting access to favorable loan terms.

- Higher Interest Rates: A lower credit score results in lenders charging higher interest rates on loans and credit cards, increasing the overall cost of borrowing.

- Difficulty Obtaining Credit: Lenders may be hesitant to approve loan applications or may offer less favorable terms to individuals with poor credit scores.

- Collection Agencies: Persistent failure to make payments can result in your debt being sent to collections, further damaging your credit score and potentially leading to legal action.

Step-by-Step Guide for Managing Credit Card Debt Effectively

Effective debt management requires a structured approach. This guide Artikels steps to regain control of your finances and improve your credit score.

- Create a Budget: Track your income and expenses to identify areas where you can reduce spending and allocate funds towards debt repayment.

- List Your Debts: Compile a list of all your credit card debts, including balances, interest rates, and minimum payments.

- Prioritize Your Debts: Consider strategies like the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche (paying off the highest-interest debt first for cost savings).

- Develop a Repayment Plan: Determine how much you can afford to pay each month towards your debts and stick to your plan.

- Consider Debt Consolidation: Explore options like balance transfer cards or personal loans to consolidate your debts into a single, potentially lower-interest payment.

- Seek Professional Help: If you’re struggling to manage your debt, consider seeking help from a credit counselor or financial advisor.

Examples of Responsible and Irresponsible Credit Card Use

These scenarios illustrate the impact of responsible and irresponsible credit card habits on credit scores.

- Responsible Use: Sarah consistently pays her credit card bill in full and on time, maintains a credit utilization ratio below 10%, and only applies for credit when absolutely necessary. Her credit score reflects this responsible behavior, allowing her to secure favorable loan terms.

- Irresponsible Use: John frequently misses credit card payments, carries a high balance relative to his credit limit, and applies for multiple credit cards within a short period. His credit score suffers as a result, leading to higher interest rates and difficulty securing loans.

Credit Card Features and Their Impact on Credit

Understanding the features of a credit card is crucial for building a strong credit history. Certain aspects, seemingly minor, can significantly influence your credit score, both positively and negatively. This section will explore key features and their impact, helping you make informed decisions about which cards best suit your financial goals.

Interest Rates and Fees

High interest rates and various fees associated with credit cards can severely hinder your credit score improvement efforts. High interest rates increase the overall cost of borrowing, making it more difficult to manage debt. Carrying a high balance on a credit card with a high APR (Annual Percentage Rate) will negatively impact your credit utilization ratio, a significant factor in your credit score calculation.

Similarly, late payment fees, annual fees, and over-limit fees all negatively affect your credit report. These late or missed payments are recorded and can significantly lower your credit score. For example, consistently paying late can drop your score by dozens of points. Moreover, excessive fees can lead to increased debt, further impacting your creditworthiness. Managing fees requires careful budgeting and responsible spending habits.

Rewards Programs and Responsible Credit Card Management

While rewards programs can be attractive, they shouldn’t overshadow the primary goal of responsible credit card usage – building credit. Rewards programs, such as cashback, points, or miles, are often tied to spending. While earning rewards is beneficial, it’s crucial to avoid overspending solely to accumulate rewards. Overspending leads to higher balances and potentially higher interest payments, negating the benefits of the rewards.

Responsible management involves using rewards programs strategically, focusing on spending within your budget and paying your balance in full each month to avoid interest charges. For instance, using a card with cashback rewards on groceries and paying off the balance immediately prevents accumulating debt while earning rewards.

Comparison of Credit Card Features and Their Effect on Credit Scores

The following table summarizes the impact of various credit card features on your credit score:

| Feature | Positive Impact | Negative Impact |

|---|---|---|

| Interest Rate (APR) | Lower APRs reduce interest charges, making it easier to manage debt. | High APRs increase the cost of borrowing, potentially leading to higher balances and negatively impacting credit utilization. |

| Annual Fee | None; Annual fees are always a cost. | Annual fees add to the overall cost of using the card and can strain your budget. |

| Late Payment Fees | None; Late payments are always detrimental. | Late payments significantly lower your credit score and damage your credit history. |

| Rewards Programs | Can incentivize responsible spending and offer financial benefits when managed properly. | Overspending to earn rewards can lead to high balances and interest charges, negatively impacting your credit score. |

| Credit Limit | A higher credit limit can improve your credit utilization ratio, provided you don’t max it out. | A low credit limit can easily lead to high credit utilization if you spend frequently. |

Credit Risk, Credit Score, and Credit Cards

Understanding the intricate relationship between credit risk, credit scores, and credit card usage is crucial for building and maintaining a healthy financial profile. Credit risk is essentially the likelihood that a borrower will fail to repay their debt, while a credit score is a numerical representation of that risk. Credit cards, as a form of revolving credit, play a significant role in both assessing and influencing this risk.

Credit Risk Definition and Relationship to Credit Scores

Credit risk represents the potential financial loss a lender faces if a borrower defaults on their loan obligations. This risk is directly tied to a borrower’s credit score; a higher credit score indicates a lower credit risk, signifying a greater likelihood of repayment. Conversely, a lower credit score suggests a higher credit risk and a greater chance of default.

Lenders use credit scores to quantify this risk, influencing their decisions regarding loan approval, interest rates, and credit limits.

Credit Card Company Assessment of Credit Risk

Credit card companies employ sophisticated algorithms and models to assess credit risk. These models consider various factors from a potential borrower’s credit report, including payment history, amounts owed, length of credit history, new credit applications, and credit mix. The weighting of each factor varies among companies, but the overall goal is to predict the probability of default. They use this assessment to determine whether to extend credit, and if so, what credit limit and interest rate to offer.

Factors Contributing to Higher or Lower Credit Risk Profiles

Several key factors contribute to a higher or lower credit risk profile. A consistent history of on-time payments significantly reduces credit risk, while missed or late payments increase it. High credit utilization (the amount of credit used relative to the total available credit) also signals higher risk. A longer credit history demonstrates a track record of responsible credit management, reducing risk.

Conversely, frequently applying for new credit or having a diverse mix of credit accounts (without consistent on-time payments) can increase perceived risk. A significant debt-to-income ratio, reflecting limited ability to manage debt, further elevates credit risk.

Influence of Credit Card Usage on Credit Risk Assessment

Credit card usage directly impacts credit risk assessment. Responsible usage, characterized by consistent on-time payments and low credit utilization, demonstrates creditworthiness and reduces perceived risk. This positive behavior leads to improved credit scores and more favorable credit terms. Conversely, irresponsible usage, such as frequently missing payments, carrying high balances, or maxing out credit cards, significantly increases credit risk. This behavior results in lower credit scores and potentially higher interest rates or even credit denial.

Interplay Between Credit Risk, Credit Score, and Credit Card Usage

Imagine a three-part diagram. At the top is Credit Risk, represented by a scale tilting towards “High Risk” or “Low Risk”. Connected to this scale are two smaller boxes: Credit Score (numerical value reflecting risk level) and Credit Card Usage (responsible vs. irresponsible actions). Responsible credit card usage (low utilization, on-time payments) pushes the Credit Risk scale towards “Low Risk” and results in a higher Credit Score.

Conversely, irresponsible credit card usage (high utilization, missed payments) pushes the Credit Risk scale towards “High Risk” and results in a lower Credit Score. The arrows show the dynamic relationship: Credit card usage directly affects the credit score, which in turn reflects the overall credit risk. The lower the risk, the better the credit score and the more favorable credit terms offered.

Monitoring and Improving Credit Score

Building and maintaining a good credit score is an ongoing process. Regular monitoring and proactive steps are crucial to ensuring your score reflects your financial responsibility and helps you achieve your financial goals. Understanding how to track your credit and address any issues is key to long-term credit health.

Effectively managing your credit score involves consistent monitoring, identifying and correcting inaccuracies, and implementing strategies for improvement. This requires a proactive approach and understanding of the various resources and methods available.

Resources for Credit Score Monitoring

Several resources allow you to monitor your credit score and report. Utilizing these tools provides valuable insights into your credit health and allows for early detection of potential problems.

- AnnualCreditReport.com: This website, run by the three major credit bureaus (Equifax, Experian, and TransUnion), provides you with one free credit report from each bureau annually. While it doesn’t include your credit score, the report details your credit history, allowing you to identify potential errors.

- Credit Scoring Services: Many companies offer credit monitoring services, often providing your credit score, along with alerts for significant changes or potential fraud. These services usually come with a subscription fee, but they offer more frequent updates and additional features compared to the free annual report.

- Your Bank or Credit Union: Some financial institutions offer free credit score access to their customers as a benefit of their accounts. Check with your bank or credit union to see if this is an option available to you.

Disputing Inaccuracies in Credit Reports

Errors on your credit report can significantly impact your credit score. Understanding the process for disputing inaccuracies is vital to protecting your credit health.

- Review your credit report carefully: Identify any errors, such as incorrect account information, late payments that didn’t occur, or accounts that don’t belong to you.

- Contact the credit bureau: Each bureau has a dispute process Artikeld on their website. Follow their instructions carefully, providing supporting documentation (e.g., proof of payment, copies of contracts) to substantiate your claim.

- Follow up on your dispute: After submitting your dispute, monitor the progress and follow up if you haven’t received a response within a reasonable timeframe. The credit bureau is required to investigate your claim and update your report accordingly if the error is confirmed.

Strategies for Improving Credit Scores

Improving your credit score takes time and consistent effort. Several strategies can help you achieve a better credit rating.

- Pay your bills on time: This is the single most important factor influencing your credit score. Consistent on-time payments demonstrate financial responsibility.

- Keep your credit utilization low: Aim to keep your credit card balances below 30% of your credit limit. High utilization ratios negatively impact your score.

- Maintain a mix of credit accounts: A diverse credit portfolio, including credit cards and installment loans, can positively influence your score, demonstrating responsible management of various credit types.

- Don’t open too many new accounts in a short period: Opening several new credit accounts within a short timeframe can negatively impact your score. Space out applications over time.

- Monitor your credit report regularly: Regularly checking your credit report allows you to catch errors early and address them promptly, preventing unnecessary damage to your credit score.

Flowchart for Credit Score Improvement

A visual representation can simplify the process of improving your credit score. The following flowchart Artikels the steps to take:

[Imagine a flowchart here. The flowchart would begin with “Credit Score Needs Improvement?”. A “Yes” branch would lead to “Obtain Credit Report,” then “Identify Errors,” then “Dispute Errors (if any),” then “Analyze Credit Usage,” then “Pay Down Debt,” then “Maintain Low Credit Utilization,” then “Pay Bills on Time,” then “Monitor Credit Score Regularly.” A “No” branch would lead to “Maintain Good Credit Habits.”]

Ultimately, improving your credit score through credit card usage hinges on responsible financial behavior. By carefully selecting a credit card suited to your needs and diligently following best practices for responsible spending and repayment, you can transform your credit profile. Remember that consistent, on-time payments and maintaining low credit utilization are paramount. Regularly monitoring your credit report and proactively addressing any inaccuracies are also crucial steps towards achieving a healthier financial future.

This journey requires commitment, but the rewards of a strong credit score are well worth the effort.

FAQ Insights

What is a credit utilization ratio, and why is it important?

Credit utilization is the percentage of your available credit you’re currently using. Keeping it low (ideally under 30%) signals responsible credit management and positively impacts your score.

How often should I check my credit report?

You’re entitled to a free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) annually. Checking regularly helps you identify and address any errors.

Can I get a credit card with bad credit?

Yes, secured credit cards require a security deposit, reducing the lender’s risk and making them accessible even with poor credit. These can help rebuild your credit history.

What happens if I miss a credit card payment?

Missing payments severely damages your credit score. Late payments are reported to credit bureaus, impacting your creditworthiness for years.