The world of corporate bonds, while offering the potential for substantial returns, is fraught with inherent risks. Understanding credit risk, the possibility of a bond issuer defaulting on its obligations, is paramount for investors seeking to navigate this complex landscape. This exploration delves into the multifaceted nature of credit risk in corporate bonds, examining its origins, assessment methods, and management strategies across varying economic climates.

We will uncover the crucial role of credit ratings, financial analysis, and risk mitigation techniques in making informed investment decisions.

From analyzing the financial health of corporations to understanding the impact of macroeconomic factors, this analysis equips investors with the knowledge to evaluate the creditworthiness of bond issuers and build resilient portfolios. We’ll explore both investment-grade and high-yield bonds, examining their respective risk profiles and highlighting the critical differences in their potential for both reward and loss. The goal is to provide a clear and practical understanding of this vital aspect of fixed-income investing.

Defining Credit Risk in Corporate Bonds

Credit risk in corporate bonds represents the potential for a bond issuer to default on its debt obligations, failing to make timely interest payments or repay the principal amount at maturity. This risk is inherent in all corporate bonds, but its magnitude varies significantly depending on several factors, impacting the potential returns and losses for investors.Factors Contributing to Credit Risk in Corporate BondsSeveral interconnected factors contribute to the credit risk profile of a corporate bond.

Understanding these factors is crucial for investors to assess the risk-reward trade-off associated with a particular bond. These factors can be broadly categorized into financial, operational, and macroeconomic influences. Financial factors include the issuer’s leverage (debt-to-equity ratio), profitability (profit margins, return on assets), and cash flow generation capacity. Operational factors encompass the issuer’s business model, management quality, competitive landscape, and industry dynamics.

Macroeconomic factors include overall economic conditions, interest rate changes, and regulatory environment. A high debt load, declining profitability, and weak cash flows are all red flags signaling potentially elevated credit risk. Conversely, a strong balance sheet, consistent profitability, and robust cash flows typically suggest lower credit risk.

Investment-Grade vs. High-Yield Corporate Bonds

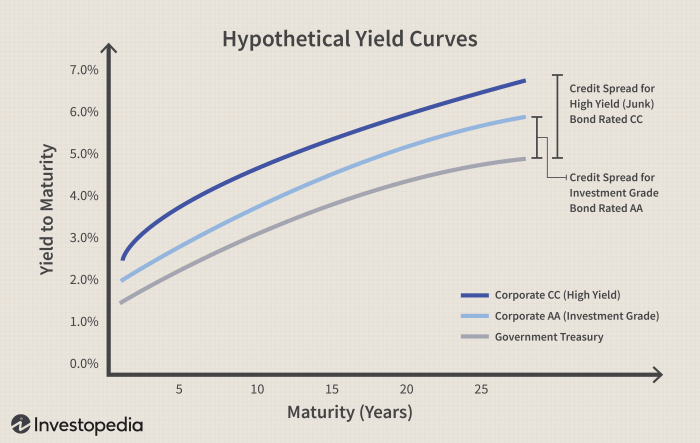

Investment-grade corporate bonds are rated BBB- or higher by credit rating agencies (such as Moody’s, S&P, and Fitch). These bonds are generally considered to have a lower probability of default compared to high-yield bonds. High-yield corporate bonds, also known as junk bonds, are rated BB+ or lower. These bonds offer higher yields to compensate investors for the significantly increased risk of default.

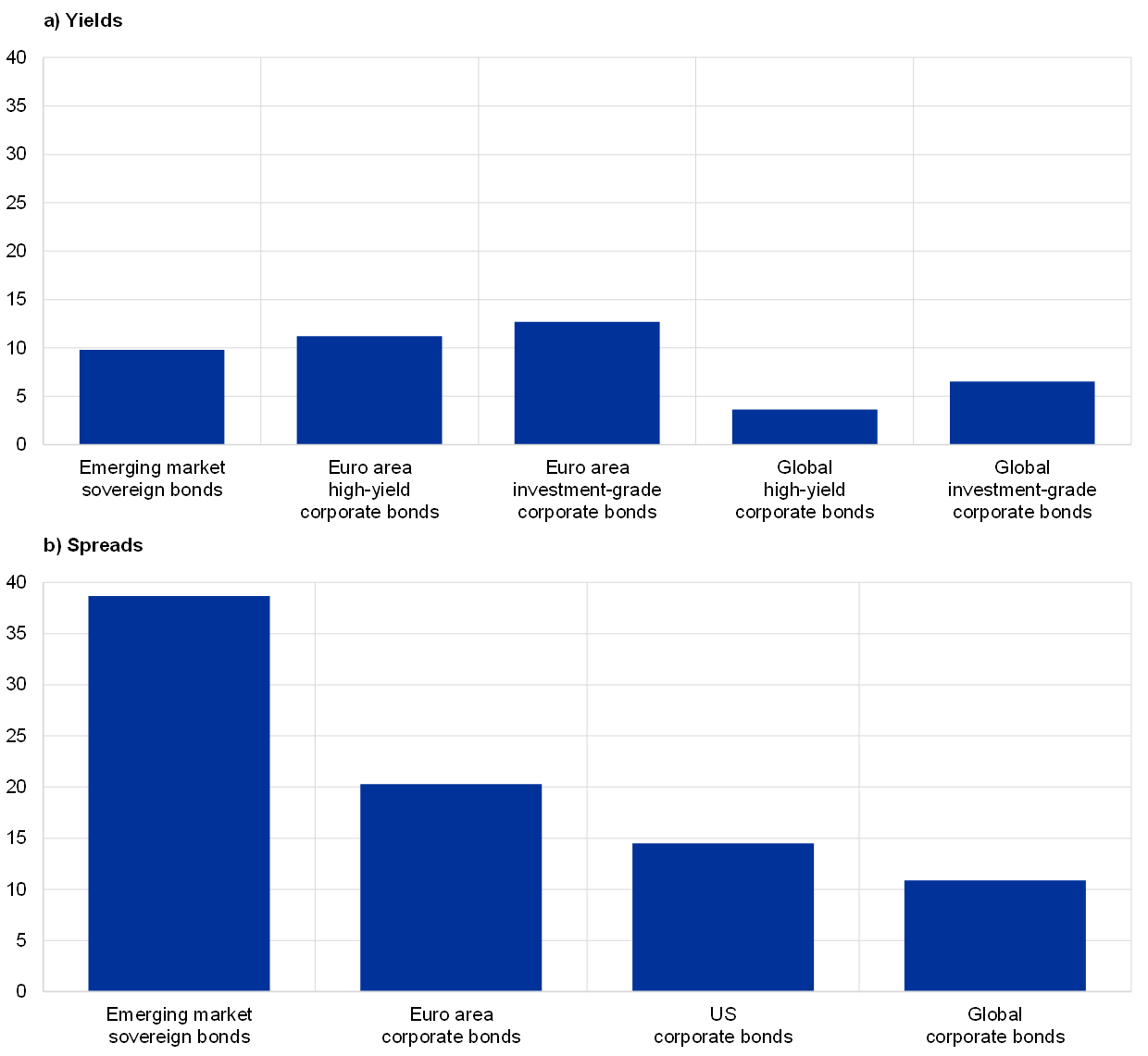

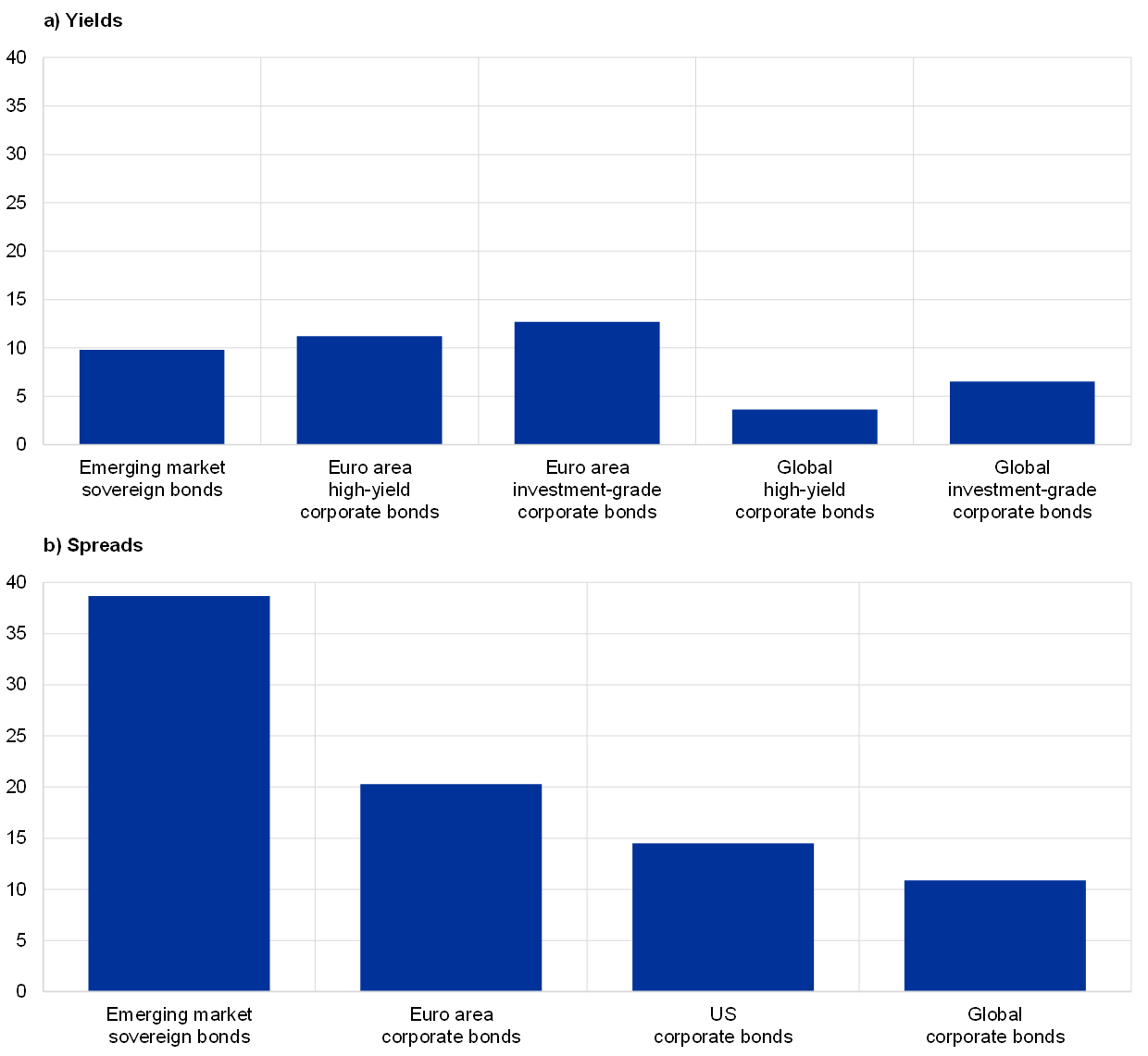

The difference in credit risk is reflected in the yield spread—the difference between the yield on a corporate bond and a comparable government bond. High-yield bonds typically have a much wider yield spread than investment-grade bonds. The higher yield reflects the increased risk of default and the possibility of losing the principal investment.

Events Increasing Credit Risk

Several events can significantly increase the credit risk of a corporate bond issuer. A sudden and unexpected downturn in the issuer’s industry can severely impact its financial performance, leading to a higher probability of default. For example, a significant technological disruption or a major regulatory change could negatively affect the issuer’s profitability and cash flow generation. Similarly, a major accounting scandal or a significant legal challenge could severely damage the issuer’s reputation and financial stability.

A sudden increase in interest rates can also negatively impact a company’s ability to service its debt obligations, increasing its credit risk. Furthermore, a loss of key personnel, especially in senior management, can negatively impact a company’s operational efficiency and financial performance.

Hypothetical High-Credit-Risk Bond Scenario

Imagine a hypothetical scenario involving “XYZ Corp,” a manufacturer of specialized electronics. XYZ Corp issues a bond with a relatively high yield (8%) to finance a risky expansion into a new, untested market. The company’s leverage is already high, and its profitability has been declining in recent quarters. Unexpectedly, the new market proves less receptive than anticipated, and XYZ Corp experiences significantly lower-than-projected sales.

This leads to a sharp decline in its cash flows, rendering it unable to meet its debt obligations. In this scenario, the bond’s credit rating is likely to be downgraded, leading to a substantial decline in its market value. Investors holding the bond may experience significant losses, potentially including a partial or total loss of their principal investment.

Depending on the severity of the situation, the company may even file for bankruptcy, resulting in a complete loss of the bond’s value for its holders.

Assessing Credit Risk

Assessing the creditworthiness of corporate bond issuers is crucial for investors and lenders to gauge the likelihood of repayment. A thorough assessment involves a multifaceted approach, combining quantitative and qualitative analyses to form a comprehensive view of the issuer’s ability to meet its obligations. This involves examining various factors, including the issuer’s financial health, industry position, and overall economic environment.

Credit Rating Agencies and Their Methodologies

Credit rating agencies (CRAs) play a significant role in assessing credit risk. These agencies, such as Moody’s, Standard & Poor’s (S&P), and Fitch Ratings, employ sophisticated models and experienced analysts to evaluate the creditworthiness of bond issuers and assign ratings that reflect the perceived risk of default. While each agency has its unique methodology, they generally consider a wide range of factors, including financial ratios, qualitative factors (management quality, governance structure), and macroeconomic conditions.

Differences in methodologies can lead to slight variations in ratings assigned by different agencies for the same issuer. For example, one agency might place more emphasis on a company’s leverage ratio while another might prioritize its cash flow generation capacity. This highlights the importance of considering ratings from multiple agencies for a more holistic view.

Financial Statement Analysis in Credit Risk Assessment

Financial statement analysis is a cornerstone of credit risk assessment. By meticulously examining a company’s balance sheet, income statement, and cash flow statement, analysts can gain valuable insights into the issuer’s financial health, liquidity, profitability, and solvency. Key ratios derived from these statements provide quantitative measures of financial performance and risk. Analyzing trends over time is equally important, as it reveals patterns and potential warning signs.

For instance, a consistently declining current ratio could indicate worsening liquidity, increasing the risk of default. Furthermore, comparing a company’s financial ratios to industry benchmarks helps assess its relative performance and identify potential areas of concern.

Key Financial Ratios in Credit Risk Analysis

The following table summarizes four key financial ratios commonly used in credit risk analysis.

| Ratio Name | Formula | Interpretation | Example Value |

|---|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures a company’s ability to meet its short-term obligations. A higher ratio generally indicates better liquidity. | 1.8 |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Indicates the proportion of a company’s financing that comes from debt. A higher ratio suggests higher financial risk. | 0.75 |

| Times Interest Earned | EBIT / Interest Expense | Measures a company’s ability to cover its interest payments with its earnings. A higher ratio signifies lower interest risk. | 5.2 |

| Return on Assets (ROA) | Net Income / Total Assets | Measures how efficiently a company uses its assets to generate profit. A higher ROA generally suggests better profitability and lower risk. | 0.08 (8%) |

Managing Credit Risk in a Portfolio

Effective credit risk management is crucial for any portfolio holding corporate bonds. Minimizing potential losses due to defaults requires a proactive and multifaceted approach, encompassing diversification, risk mitigation tools, and robust stress testing methodologies. This section will delve into key strategies for managing credit risk within a corporate bond portfolio.

Diversification Strategies for Credit Risk Mitigation

Diversification is a cornerstone of effective credit risk management. By spreading investments across a wide range of issuers, industries, and geographies, investors can significantly reduce the impact of any single default. For instance, a portfolio heavily concentrated in the technology sector would be more vulnerable to a downturn in that specific sector than a portfolio with a diversified mix of sectors like energy, healthcare, and consumer goods.

Furthermore, diversification across different credit ratings mitigates the risk of concentrated exposure to lower-rated bonds. A well-diversified portfolio should aim for a balance between risk and return, considering the correlation between different bond issuers. Highly correlated bonds offer less diversification benefit than those with low correlation.

The Role of Credit Default Swaps (CDS) in Credit Risk Management

Credit default swaps (CDS) are derivative contracts that act as insurance against the default of a specific bond issuer. A CDS buyer pays a periodic premium to the seller in exchange for protection against losses if the issuer defaults. This allows investors to hedge their credit risk exposure, effectively transferring some or all of the default risk to the CDS seller.

For example, an investor holding a significant amount of bonds issued by a company deemed to be at high risk of default could purchase a CDS to mitigate the potential losses. However, it’s crucial to understand that CDSs are not risk-free; the seller may not be able to meet its obligations if multiple defaults occur simultaneously. The market for CDS contracts is also subject to its own liquidity risks.

Stress Testing for Assessing Portfolio Vulnerability to Credit Risk

Stress testing is a crucial tool for evaluating a portfolio’s resilience to adverse economic conditions. This involves simulating various economic scenarios, such as a sharp increase in interest rates, a recession, or a significant industry-specific shock, and analyzing the impact on the portfolio’s credit risk. For example, a stress test might simulate a 20% drop in the value of all bonds rated BB or lower, assessing the resulting losses and the portfolio’s ability to withstand such a scenario.

The results of stress tests inform portfolio adjustments, allowing investors to proactively manage potential losses by reducing exposure to vulnerable sectors or issuers. Sophisticated models, often incorporating macroeconomic factors and individual issuer-specific data, are employed for effective stress testing.

Best Practices for Managing Credit Risk in a Corporate Bond Portfolio

Effective credit risk management requires a robust framework incorporating several best practices. These include:

- Regularly review and update the portfolio’s credit risk profile, considering changes in market conditions and individual issuer creditworthiness.

- Implement a rigorous credit analysis process to evaluate the creditworthiness of potential bond issuers before investing.

- Establish clear risk tolerance limits and adhere to them consistently.

- Utilize sophisticated analytical tools and models to assess and monitor credit risk.

- Maintain a diverse portfolio to reduce concentration risk.

- Implement a robust risk reporting system to track and monitor credit risk exposures.

- Develop contingency plans to address potential credit events.

Credit Risk in Different Economic Environments

Credit risk in corporate bonds is not static; it fluctuates significantly depending on the prevailing macroeconomic environment. Economic expansions and contractions, interest rate shifts, and inflation all exert considerable influence on a company’s ability to meet its debt obligations, thereby impacting the risk associated with its bonds. Understanding these dynamics is crucial for investors and portfolio managers alike.Macroeconomic factors significantly influence credit risk in corporate bonds.

Economic growth, unemployment rates, inflation, and interest rates are key drivers. Strong economic growth generally translates to higher corporate profits and improved cash flows, reducing the likelihood of default. Conversely, economic downturns can severely strain corporate finances, increasing the probability of default. Changes in these factors ripple through the economy, affecting the creditworthiness of companies across various sectors.

Macroeconomic Factors and Credit Risk

During periods of economic expansion, businesses typically experience increased revenue and profitability. This positive economic climate reduces the probability of default on corporate bonds, leading to lower credit risk. Companies can easily meet their debt obligations and even explore opportunities for expansion. Investors are more willing to lend money at lower interest rates, reflecting this lower perceived risk.

Conversely, during economic recessions, businesses face decreased sales, lower profits, and potentially rising unemployment. This environment increases the likelihood of default, making credit risk significantly higher. Investors demand higher interest rates to compensate for the increased risk of non-payment. The increased uncertainty leads to a flight to safety, with investors shifting their investments towards lower-risk assets.

Credit Risk During Economic Expansion vs. Recession

The credit risk profile of corporate bonds differs dramatically between economic expansions and recessions. In expansions, demand for credit is high, and companies have access to easier and cheaper financing. This leads to lower default rates and lower yields on corporate bonds. Investors are generally more optimistic, leading to a higher demand for corporate bonds and thus lower yields.

Conversely, in recessions, demand for credit falls, and borrowing becomes more difficult and expensive. Defaults increase, leading to higher yields on corporate bonds as investors demand higher returns to compensate for the elevated risk. Credit rating agencies may downgrade the ratings of many corporations, further increasing the perceived risk and thus the yields.

Impact of Interest Rate Changes on Credit Risk

Interest rate changes directly affect the credit risk of corporate bonds. Rising interest rates increase borrowing costs for companies, potentially reducing their profitability and increasing their financial strain. This can lead to a higher probability of default, especially for companies with high debt levels or weak balance sheets. Conversely, falling interest rates reduce borrowing costs, improving corporate profitability and reducing the likelihood of default.

However, prolonged periods of low interest rates can also lead to excessive risk-taking and potential bubbles, which can eventually increase credit risk. For example, a company heavily reliant on variable-rate debt would face significantly increased interest expense during a period of rising rates, potentially impacting its ability to service its debt.

Inflation and Credit Risk: A Hypothetical Example

Inflation erodes the purchasing power of future cash flows, impacting the value of corporate bonds. High inflation often leads to higher interest rates as central banks try to control inflation. This, in turn, increases borrowing costs for companies, potentially affecting their ability to repay their debt. Consider a hypothetical scenario: Company X issues a 5-year bond with a fixed coupon rate of 5% during a period of low inflation (2%).

If inflation unexpectedly surges to 8%, the real return on the bond becomes negative (-3%), making it less attractive to investors. The increased risk of default due to higher borrowing costs and reduced profitability, coupled with the reduced real return, would likely increase the credit risk associated with Company X’s bonds. Investors would demand a higher yield to compensate for the increased risk, reflecting the impact of inflation on creditworthiness.

Successfully navigating the complexities of credit risk in corporate bonds requires a multifaceted approach. By combining a thorough understanding of credit rating methodologies, robust financial statement analysis, and effective portfolio diversification strategies, investors can significantly mitigate their exposure to potential losses. This analysis has highlighted the dynamic interplay between macroeconomic factors, interest rate fluctuations, and the creditworthiness of bond issuers.

Ultimately, a proactive and informed approach to credit risk assessment is crucial for achieving long-term success in the corporate bond market.

Question & Answer Hub

What is a credit default swap (CDS)?

A credit default swap is a derivative contract that transfers credit risk from one party to another. Essentially, it’s an insurance policy against a bond issuer defaulting.

How does inflation impact corporate bond credit risk?

High inflation can erode the real value of future bond payments, increasing the risk of default, especially for companies with high debt burdens.

What are the implications of a company’s downgrade to junk status?

A downgrade to junk status (below investment grade) significantly increases the perceived risk of default, leading to lower bond prices and potentially higher yields to compensate investors for the increased risk.

How can I diversify my corporate bond portfolio to reduce credit risk?

Diversification involves investing in bonds issued by companies across different sectors and geographies, as well as considering bonds with varying credit ratings.