Understanding your credit score is crucial for navigating the financial landscape. It impacts everything from loan approvals and interest rates to even securing an apartment. However, misinformation abounds, leading many to make costly mistakes. This exploration delves into common myths surrounding credit scores, separating fact from fiction to empower you with accurate knowledge for better financial management.

We’ll examine the key factors influencing your credit score, providing actionable steps to improve it and strategies to mitigate credit risk. By dispelling pervasive myths and presenting clear facts, we aim to equip you with the tools to make informed decisions and build a strong financial future.

Introduction to Credit Scores

Understanding your credit score is crucial for navigating the financial landscape. It’s a numerical representation of your creditworthiness, influencing your access to credit and the terms you’ll receive. A good credit score opens doors to better loan rates, lower insurance premiums, and even better job opportunities in some sectors. Conversely, a poor score can significantly limit your financial options.A credit score is a three-digit number, typically ranging from 300 to 850 (though the specific range can vary slightly depending on the scoring model), generated by credit bureaus based on your credit history.

Its components include payment history (the most significant factor), amounts owed, length of credit history, new credit, and credit mix. Each of these factors contributes to the overall score, with payment history carrying the most weight.

Credit Score Impact on Borrowing

Credit scores directly influence the interest rates you’ll qualify for when borrowing money. For example, someone with a high credit score (e.g., 750 or above) might qualify for a mortgage with an interest rate of 4%, while someone with a lower score (e.g., 600 or below) might face an interest rate of 7% or higher for the same loan.

This difference in interest rates can translate to thousands of dollars in extra interest paid over the life of the loan. Similarly, a good credit score significantly increases the likelihood of loan approval. A low score can lead to loan applications being rejected outright or result in significantly smaller loan amounts being offered. Imagine trying to buy a house – a poor credit score could mean the difference between securing a mortgage and being unable to purchase your dream home.

Common Credit Score Myths

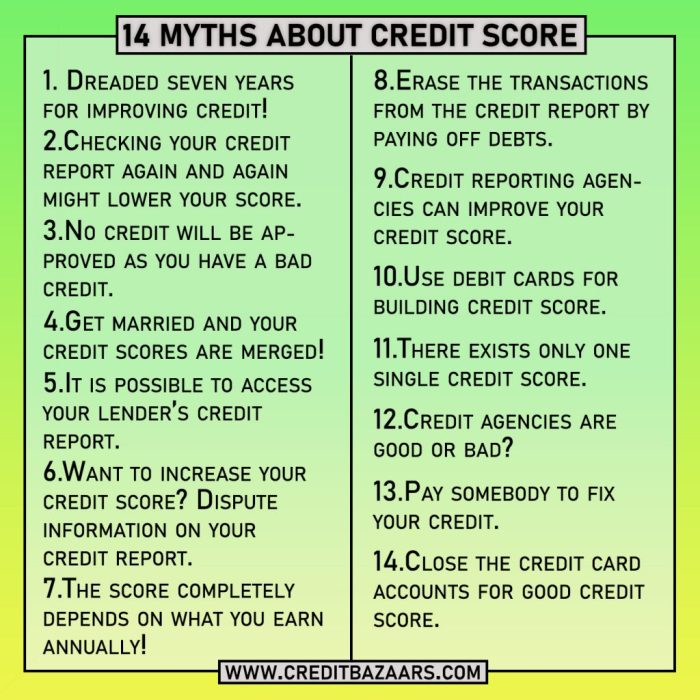

Understanding your credit score is crucial for financial well-being, but many misconceptions surround this important number. Let’s debunk some common myths that can lead to confusion and potentially harm your credit health. These myths often stem from misinformation and a lack of understanding about how credit scoring actually works.

Checking Your Credit Score Does Not Hurt Your Credit

Contrary to popular belief, checking your own credit score does not negatively impact your creditworthiness. The inquiries you make yourself, often referred to as “soft inquiries,” don’t affect your score. These are different from “hard inquiries,” which occur when lenders check your credit as part of a loan application. Many free credit monitoring services and banks provide access to your score without impacting your credit report.

Regularly reviewing your credit report allows you to identify and address any potential errors or fraudulent activity, proactively protecting your credit health.

Credit Score Impacts Extend Beyond Loan Applications

The influence of your credit score reaches far beyond loan applications. While securing loans is a significant aspect, your credit score plays a role in various other financial decisions. Landlords often use credit scores to assess rental applications. Insurance companies may use them to determine premiums. Even some employers might consider your credit score during the hiring process, though this practice is increasingly scrutinized.

Maintaining a healthy credit score is, therefore, beneficial across a wide range of financial interactions.

Paying Off Debt Does Not Instantly Boost Scores

While paying down debt is undoubtedly positive for your credit health, it doesn’t result in an immediate, dramatic improvement in your score. Credit scoring models consider your payment history over time, and the positive impact of paying off debt is reflected gradually. While a significant reduction in debt utilization (the percentage of available credit used) can lead to a noticeable score increase over several months, expecting an overnight jump is unrealistic.

Consistent responsible financial behavior over an extended period is key to a strong credit score.

No Single Credit Card is Essential for Building Credit

There’s no magic credit card that guarantees a perfect credit score. The key to building credit is responsible credit use, regardless of the specific card. Focusing on consistent on-time payments, keeping your credit utilization low, and managing your debt responsibly are far more important than the type of card you possess. Starting with a secured credit card, if necessary, is a good strategy, but the focus should always be on responsible credit management.

Improving Your Credit Score

A low credit score can limit your financial opportunities, impacting everything from loan approvals to insurance rates. Fortunately, improving your credit score is achievable with consistent effort and strategic planning. By understanding the factors that influence your score and implementing effective strategies, you can significantly enhance your financial standing over time.

Actionable Steps to Improve a Low Credit Score

Improving your credit score requires a multifaceted approach. It’s not a quick fix, but rather a process of consistent responsible financial behavior. Key steps involve paying down debt, maintaining consistent positive payment history, and monitoring your credit report for accuracy.

- Pay down existing debt: High credit utilization (the amount of credit you’re using compared to your total available credit) negatively impacts your score. Aim to keep your credit utilization below 30%, ideally below 10%. For example, if you have a $10,000 credit limit, try to keep your balance below $1,000, or even better, below $1000. This demonstrates responsible credit management.

- Make on-time payments: Payment history is the most significant factor in your credit score. Even one missed payment can have a substantial negative impact. Set up automatic payments or reminders to ensure timely payments on all credit accounts.

- Maintain a mix of credit accounts: A diverse credit history, including credit cards, installment loans (like auto loans), and mortgages (if applicable), can positively influence your score. However, this should be done responsibly and not by taking on unnecessary debt.

- Avoid opening multiple new accounts in a short period: Each new credit application results in a hard inquiry on your credit report, which can temporarily lower your score. Only apply for credit when necessary.

- Keep older accounts open: The age of your credit accounts contributes to your credit score. Closing old accounts, even if you’ve paid them off, can shorten your credit history and negatively impact your score.

- Monitor your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) annually for errors. Dispute any inaccuracies immediately.

Step-by-Step Plan for Managing Credit Card Debt Effectively

Effective credit card debt management requires a structured approach. This involves prioritizing debt repayment, budgeting effectively, and considering debt consolidation options where appropriate.

- Create a budget: Track your income and expenses to identify areas where you can reduce spending and allocate more funds towards debt repayment.

- Prioritize high-interest debt: Focus on paying down credit cards with the highest interest rates first, using methods like the debt avalanche or debt snowball method. The debt avalanche method focuses on paying off the highest interest debt first, while the debt snowball method focuses on paying off the smallest debt first for motivational purposes.

- Consider debt consolidation: A balance transfer credit card or a personal loan might offer a lower interest rate, making it easier to manage and pay off your debt faster. Be sure to compare interest rates and fees carefully before making a decision.

- Negotiate with creditors: If you’re struggling to make payments, contact your creditors to discuss options like hardship programs or payment plans. They may be willing to work with you to avoid delinquency.

- Avoid accumulating more debt: Once you’ve started paying down your debt, it’s crucial to avoid taking on new debt to maintain progress.

Best Practices for Responsible Credit Card Usage

Responsible credit card usage is fundamental to maintaining a healthy credit score. It’s about using credit wisely and avoiding behaviors that can negatively impact your financial health.

- Always pay your bills on time.

- Keep your credit utilization low (ideally below 30%).

- Review your credit card statements regularly for errors.

- Avoid cash advances, as they typically come with high fees and interest rates.

- Understand your credit card terms and conditions.

- Protect your credit card information from theft or fraud.

Strategies for Disputing Inaccurate Information on Credit Reports

Inaccuracies on your credit report can significantly harm your credit score. Knowing how to effectively dispute errors is crucial for protecting your financial well-being.

- Review your credit reports: Obtain your free credit reports annually from AnnualCreditReport.com and carefully review them for any inaccuracies.

- Prepare a dispute letter: Write a formal letter to each credit bureau detailing the specific inaccuracies you’ve found, including dates, account numbers, and supporting documentation (e.g., proof of payment, copies of bills).

- Submit your dispute: Send your dispute letter via certified mail with return receipt requested to ensure the credit bureau receives it. Keep copies of all correspondence.

- Follow up on your dispute: After submitting your dispute, follow up with the credit bureau to check on the status of your request. If the error isn’t corrected, consider contacting a consumer credit counseling agency or a credit repair company.

Credit Cards and Credit Risk

Credit cards offer convenience and financial flexibility, but they also present significant risks if not managed responsibly. Understanding the different types of credit cards, their associated risks, and the impact of credit card usage on your credit score is crucial for maintaining good financial health. This section explores the relationship between credit cards and credit risk, highlighting factors lenders consider and strategies for mitigating potential problems.

Types of Credit Cards and Associated Risks

Credit cards come in various forms, each with its own set of benefits and drawbacks. Secured credit cards, requiring a security deposit, typically carry lower credit limits and higher interest rates but are easier to obtain for individuals with limited credit history. Unsecured credit cards, which don’t require a security deposit, often offer higher credit limits and lower interest rates but require a stronger credit history for approval.

Rewards credit cards offer cashback, points, or miles for purchases, but often come with higher annual fees and interest rates. The risk associated with each type depends on the individual’s ability to manage their spending and repayment. For example, a rewards card can be beneficial for responsible users who pay their balances in full each month, but it can become a liability for those who carry a balance and incur high interest charges.

Credit Card Usage and Credit Scores

Your credit card usage significantly impacts your credit score. Responsible credit card management, characterized by consistent on-time payments and low credit utilization (the percentage of your available credit you’re using), contributes positively to your score. Conversely, missed payments, high credit utilization, and exceeding your credit limit negatively affect your credit score. Lenders view consistent responsible credit card use as an indicator of financial responsibility, while irresponsible usage signals higher risk.

For instance, consistently paying your balance in full each month demonstrates responsible credit management, while carrying a high balance indicates potential financial strain.

Factors Lenders Consider in Credit Card Applications

When assessing credit card applications, lenders consider several factors beyond your credit score. These include your income, employment history, debt-to-income ratio (DTI), and length of credit history. A stable income and consistent employment history demonstrate your ability to repay the debt. A low DTI, representing the proportion of your income allocated to debt payments, indicates lower risk. A longer credit history, showing a track record of responsible credit management, is also favorable.

Lenders use a combination of these factors to assess your creditworthiness and determine your eligibility for a credit card and the credit limit they’re willing to offer.

Risks Associated with High Credit Utilization and Debt

High credit utilization and significant credit card debt pose substantial risks. High credit utilization, generally considered to be above 30%, negatively impacts your credit score. High debt burdens can lead to financial stress, difficulty meeting other financial obligations, and potential defaults. For example, carrying a high balance on multiple credit cards can result in high interest payments, reducing your disposable income and potentially leading to a cycle of debt.

This can significantly impact your ability to manage other expenses and achieve your financial goals.

Strategies for Mitigating Credit Card Risk

Developing and implementing effective strategies is crucial for minimizing credit card risk.

- Pay your balance in full and on time each month: This avoids interest charges and demonstrates responsible credit management.

- Keep your credit utilization low: Aim to keep your credit utilization below 30% of your available credit to maintain a positive impact on your credit score.

- Monitor your credit report regularly: Check for errors and identify any potential issues early on.

- Budget effectively: Track your spending and ensure you can comfortably afford your credit card payments.

- Choose credit cards wisely: Select cards that align with your spending habits and financial goals, considering factors like interest rates, fees, and rewards.

- Consider a balance transfer: If you have high-interest debt, explore balance transfer options to lower your interest rate and accelerate debt repayment.

Credit Score and Credit Risk Management

Understanding your credit score is crucial for effectively managing your credit risk. A higher credit score signifies lower risk to lenders, leading to more favorable loan terms and lower interest rates. Conversely, a lower score indicates higher risk, resulting in less advantageous offers or even loan denials. This section explores the practical implications of credit scores on financial decisions and the importance of proactive credit management.Your credit score acts as a financial report card, summarizing your creditworthiness to potential lenders.

Lenders use this score to assess the probability of you repaying a loan on time. A good credit score, typically above 700, often translates to lower interest rates on mortgages, auto loans, and credit cards. For instance, someone with a credit score of 750 might qualify for a mortgage with an interest rate of 4%, while someone with a score of 600 might face an interest rate of 7% or higher, significantly increasing the total cost of the loan over its lifetime.

Similarly, a higher credit score can lead to more favorable loan terms, such as longer repayment periods or lower down payments.

Interest Rates and Loan Terms

The impact of credit scores on interest rates and loan terms is substantial. Lenders categorize borrowers based on their credit scores into different risk tiers. Borrowers with higher credit scores are considered lower risk and are therefore offered lower interest rates and more favorable loan terms. For example, a person with an excellent credit score might secure a personal loan with a 6% interest rate and a 5-year repayment period, while a person with a poor credit score might only qualify for a loan with a 15% interest rate and a shorter repayment period, potentially leading to higher monthly payments and a greater total repayment amount.

This difference in interest rates and loan terms can amount to thousands of dollars over the life of a loan.

Credit Report Monitoring

Regularly monitoring your credit report is essential for maintaining a healthy credit score and mitigating potential risks. Errors can occur on credit reports, and identifying and disputing these inaccuracies is crucial to protecting your creditworthiness. Furthermore, monitoring your credit report allows you to detect any signs of identity theft or fraudulent activity early on, enabling timely intervention to minimize potential damage.

Many credit bureaus offer free credit reports, making regular monitoring a straightforward process.

Consequences of Ignoring Negative Information

Ignoring negative information on your credit report can have serious financial consequences. Negative marks, such as late payments or collections, can significantly lower your credit score, making it more difficult to obtain loans, rent an apartment, or even secure certain jobs. Furthermore, ignoring these issues can lead to escalating debt and potential legal action from creditors. Addressing negative information promptly and working with creditors to resolve outstanding issues is crucial for protecting your financial well-being.

Proactive credit management, including regular monitoring and prompt action on any negative information, is vital for maintaining a healthy credit score and minimizing credit risk.

Illustrative Example: The Impact of Late Payments

Late payments significantly impact your credit score, potentially leading to higher interest rates and difficulty securing loans or credit in the future. The severity of the impact depends on several factors, including the frequency of late payments and how late the payments are. Even a single late payment can negatively affect your score, but repeated late payments will cause a more substantial decline.Let’s consider the case of Sarah, a young professional who initially maintained a good credit score of 720.

Due to unforeseen circumstances, she experienced a period of financial instability. In the first month, she was 10 days late on her credit card payment. This resulted in a minor dip in her score, down to approximately 700. However, in the following two months, she was 30 days late on both her credit card and her car loan payments.

This significantly impacted her credit score, dropping it to around 650. The repeated late payments, coupled with the increasing duration of the lateness, demonstrated a pattern of poor payment behavior, leading to a more severe penalty.

Credit Score Decline Visualization

Imagine a graph charting Sarah’s credit score over time. The x-axis represents time in months, starting with her initial score of 720. The y-axis represents her credit score. The line starts at 720 and remains relatively flat for several months, representing her consistent on-time payments. Then, a noticeable drop occurs after the first 10-day late payment.

The line descends further and more steeply after the subsequent 30-day late payments on both accounts. The graph clearly illustrates the cumulative effect of repeated late payments, showing a progressively sharper decline in her credit score. The visual representation would clearly show how a consistent pattern of on-time payments leads to a stable score, while a pattern of late payments, especially those that are increasingly late, causes a substantial and accelerating decrease in creditworthiness.

The graph would visually emphasize the importance of consistent on-time payments for maintaining a healthy credit score.

Mastering your credit score is not about arcane secrets; it’s about understanding the system and using that knowledge to your advantage. By debunking common myths and embracing responsible credit practices, you can significantly improve your financial well-being. Remember, consistent monitoring, proactive management, and a commitment to responsible borrowing are the cornerstones of a healthy credit profile. Take control of your financial future – start today.

General Inquiries

How often should I check my credit score?

Checking your credit score regularly (monthly or quarterly) is recommended to monitor for errors or unexpected changes. Many services offer free credit score checks.

Does paying off a collection account improve my score immediately?

While paying off collections is positive, the impact isn’t immediate. It takes time for the positive information to be reflected in your score. The improvement will gradually show up over several reporting cycles.

Can I get a loan with a low credit score?

Yes, but it’s more challenging and will likely come with higher interest rates. Consider improving your credit score before applying for a loan to secure better terms.

What’s the difference between a credit score and a credit report?

A credit report is a detailed history of your credit activity. Your credit score is a numerical representation derived from your credit report, summarizing your creditworthiness.